PeerBerry – Deep Dive

Overview

Established in 2017 by Aventus Group and headquartered in Vilnius, Lithuania, PeerBerry is a dynamic peer-to-peer (P2P) lending platform. It offers investors the opportunity to lend money to individuals and businesses across various countries. With a mission centered on facilitating passive income opportunities globally, PeerBerry has rapidly grown since its inception. The platform boasts an impressive track record, attracting over 75,000 investors who have collectively invested over €2 billion and earned in excess of €23 million in returns. This remarkable growth underscores PeerBerry’s commitment to providing accessible and lucrative investment options.

Key advantage of the platform

PeerBerry stands out in the P2P lending market with its robust buyback guarantee, ensuring investor protection in the event of borrower default. This guarantee is backed by the loan originator, providing an additional layer of security for investments. Since its inception, PeerBerry has facilitated over €2 billion in loans, demonstrating its effectiveness and reliability as a lending platform. Notably, as of the writing of this article, PeerBerry has maintained an exceptional record with no reported defaults, highlighting its stringent risk management and credit assessment processes.

Track records

Historical returns

Net return

Default rate

Data is not available

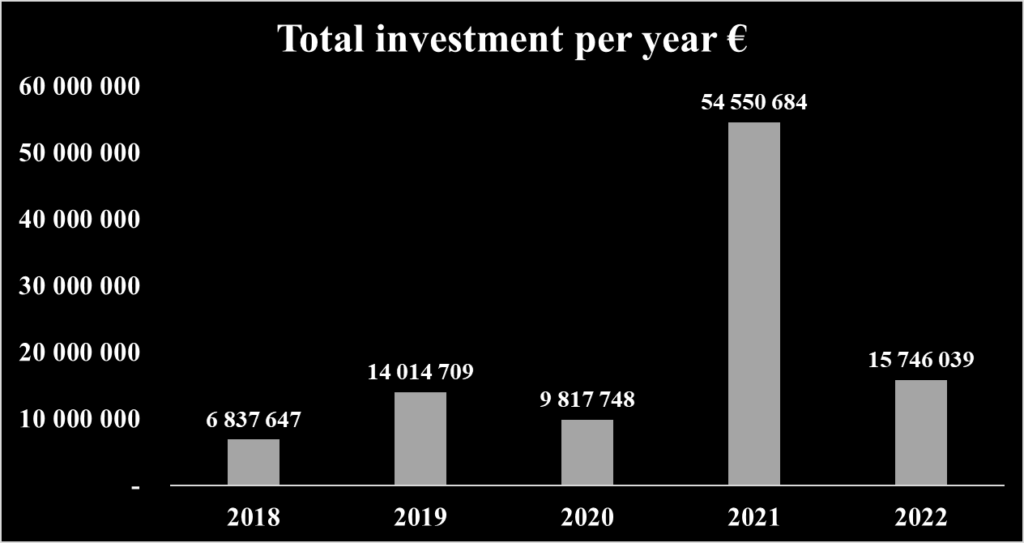

Total investment on the platform per year

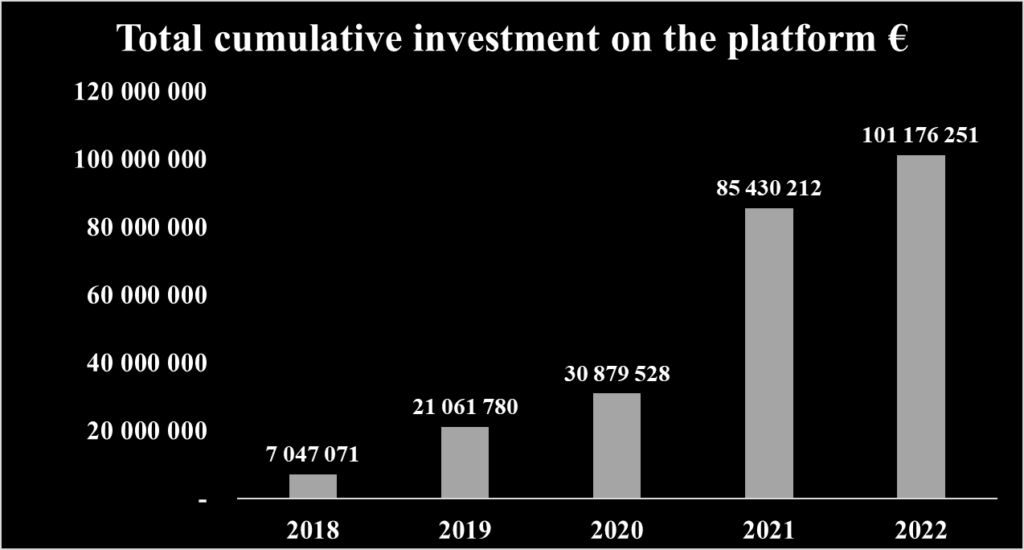

Total cumulative investment on the platform

Investment opportunities

PeerBerry is a peer-to-peer lending platform that enables investors to invest on short-term loans for businesses and individuals in multiple countries.

The minimum amount to invest into PeerBerry’s project for investor is 10 €

| Loan ID | Loan ID 12375432 | Loan ID 12375399 | Loan ID 12375406 |

| Parent company | SIB Group | SIB Group | SIB Group |

| Amount | 20 000 € | 20 000 € | 20 000 € |

| Interest rate | 9% | 9% | 9% |

| Available for investment | 18 843,51 € | 16 521,48 € | 19 180 € |

| Already funded | 1 156,49 € | 3 478,16 € | 820 € |

| Types of guarantee | Buyback guarantee | Buyback guarantee | Buyback guarantee |

| Loan type | Real estate | Real estate | Real estate |

| Loan originator | LLC Pakrantés bustas | LLC Pakrantés bustas | LLC Pakrantés bustas |

| Loan to value LTV | 47% | 80% | 80% |

| Country | Lithuania | Lithuania | Lithuania |

| Need for funding | 1200000 € | 2550000 € | 2550000 € |

All loans offered on the platform are securitized by a buy back guarantee from the loan originator. In cases where a loan originator can’t fulfill this guarantee, a Group Guarantee comes into play, with the parent company covering the obligations. It is important to note that not all parent companies offer a Group Guarantee.

Investing process as a retail investors

- Account Creation: The first step for investors on PeerBerry is to create an account, which involves submitting personal and financial details such as name, surname, email, and phone number.

- Exploring Investment Opportunities: Investors are then able to explore a variety of investment options available on PeerBerry. The platform provides comprehensive information on each project, enabling investors to conduct quick due diligence. Every investment opportunity is detailed on its own page, which includes information about the loan originator company and the specifics of the investment.

- Making an Investment Decision: After reviewing the investment details, investors can choose to proceed with their investment. Options include manually selecting specific loans to fund or utilizing the Auto Invest feature to set up a portfolio strategy tailored to their preferences.

- Investment Monitoring: Post-investment, investors can track the progress of their investments through their PeerBerry accounts. The platform ensures regular updates are provided on the projects, keeping investors informed about their investments.

Team and management

PeerBerry is led by a team of experts with a wealth of experience and a proven track record of accomplishments in management.

Arunas Lekavicius, CEO of PeerBerry

Arunas Lekavicius, serving as the CEO of PeerBerry since January 2019, has accumulated extensive experience in financial services and leadership. Prior to joining PeerBerry, he was the Head of Leasing Product at 4finance from March 2015 to December 2018. He also held the position of Head of Leasing at Luminor Group from July 2011 to March 2015. Lekavicius’ tenure at SEB spanned over four years, where he progressed through several roles, including Business Customers Project Manager, Private Customers Manager, and Customer Service Manager, demonstrating a breadth of expertise in customer relationship management and business development.

Rita Simanavičiūtė, CM&CO of PeerBerry

Rita Simanavičiūtė has been the Chief Marketing & Communications Officer at PeerBerry since September 2019, and also partners with Aventus Group for investor relations since September 2020. Previously, she led corporate communications at Citadele bankas Lietuvoje for over four years and held marketing roles at UAB Švyturys – Utenos alus and Swedbank Leasing. Academically, she holds an MBA from Pforzheim University, specializing in Marketing and International Business Management, and another MBA in International Business Management from Vilnius University Business School, along with a BBA in Business Administration and Management from Vilnius Gediminas Technical University.

Mission and Values

PeerBerry’s mission centers on fostering a transparent and efficient nexus between investors and borrowers, facilitating their financial goals. The platform is steadfast in its commitment to transparency, providing comprehensive insights into the risks and rewards inherent in peer-to-peer lending. Additionally, PeerBerry places a high value on operational efficiency and continual innovation, striving to constantly elevate the user experience. This approach underscores PeerBerry’s dedication to maintaining an environment where both investors and borrowers can make informed and beneficial financial decisions.

Trustfulness of the platform

Key investors of the company

| AventusGroup | |

| Assets under management | NA |

| Date of creation | 2009 |

| Founder | Andrejus Trofimovas |

| Website | https://aventusgroup.com/ |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

PeerBerry is currently submitting a monthly report to the FCMC, the Latvian regulator, even though they do not yet have a license. FCMC stands for the Financial and Capital Market Commission. It is the regulatory authority in Latvia responsible for overseeing and regulating financial and capital market activities in the country.

Fees and charges

Investing through PeerBerry is completely free of charge. PeerBerry does not charge any fees for opening an account, depositing or withdrawing funds. PeerBerry’s only income is a commission received from business partners.

Liquidity and exit options

The PeerBerry platform lacks a secondary market, therefore Investors must retain their loans until they reach maturity and are unable to sell their investments through the platform.

Users feedback

| Trustpilot | |

| Average rate | 3,9/5 |

| Good review | I’ve tried many crowdlending platforms such as Mintos, Estateguru and in my opinion, PeerBerry is more reliable. I started investing this year and I’ve never had any defaulted loan or high amounts in the 16-30 bucket. My only problem is the cash drag as my automatic strategy doesn’t really do its homework. I need to check it every day once the app notifies me that I have uninvested funds on my account. So everything is manual but the platform is just much more trustable than others. |

| Bad review | Peerberry unfortunately has not been able to attract good new lenders to the site, so when more people started to use the site the experience has fallen off a cliff. There are only a couple minutes in the morning when short term loans are available and if you dont happen to refresh your browser at that moment they are gone. Still even if you happen to be on time, most loans will be gone, before you invested all of your account, so expect heavy cash drag, the requirement to monitor the site closely and already significantly lowered interest rates. |

Risk Analysis

Investors using this platform should be conscious of specific significant risks and grasp the platform’s risk management strategies to safeguard their funds.

Credit risk

Borrower default risk

PeerBerry’s approach to managing borrower default risk is characterized by an exhaustive due diligence process. This process entails a comprehensive assessment of loan applicants, incorporating a variety of methods:

- Market Analysis: PeerBerry conducts detailed analyses of each market, utilizing approximately 15-20 sources to gather information on borrowers. This includes standard demographic data and credit bureau histories.

- Behavioral Evaluation: The platform extends its scrutiny to customer behavior during the application process. This involves analyzing subtle interactions, such as the frequency of cursor movements when selecting loan amounts or the use of hotkeys. Such behavioral insights are centrally managed in a decision-making center, which is adept at adapting to varying risk parameters in each market.

- Default Management: Notably, PeerBerry’s platform has not experienced any loan defaults. Although the onset of the war in Ukraine posed potential default risks for some contracts, proactive measures have been taken by PeerBerry to ensure the repayment of these at-risk loans. To date, no loans on the platform have been classified as defaults, reflecting PeerBerry’s effective risk management strategies.

Platform risk

Operational risk

PeerBerry rigorously addresses operational risks with a strong focus on data security. The platform employs advanced encryption and digital certificates to safeguard data transmissions. This commitment to security is further reinforced through continuous reviews and tests of their encryption and security protocols, ensuring their effectiveness against evolving threats.

In an effort to combat spam and maintain website integrity, PeerBerry integrates Google reCAPTCHA, effectively distinguishing human users from automated systems. Adhering to GDPR regulations, data storage is managed on EU servers, reflecting a commitment to data protection and privacy. For user authentication, PeerBerry utilizes Google Authenticator, providing an added layer of security through two-step verification. This comprehensive approach to security underscores PeerBerry’s dedication to maintaining a secure and trustworthy platform for its users.

Regulatory risk

PeerBerry, operating as a peer-to-peer (P2P) lending platform, is currently under the surveillance of the Latvian financial regulatory authority. As of now, PeerBerry has not obtained any specific licenses. However, the platform has proactively applied for an Investment Brokerage Firm License from the Financial and Capital Market Commission (FCMC). Upon receiving this license, PeerBerry is set to become one of the first regulated alternative investment platforms in Europe. Regarding the implementation of the European Crowdfunding Service Provider (ECSP) regulation, which is mandatory for European crowdfunding companies by November 2023, PeerBerry has not yet disclosed any specific information on its compliance plans. This situation highlights the evolving regulatory landscape in which PeerBerry operates.

Platform failure

PeerBerry operates primarily as an intermediary, facilitating connections between investors and loan originators. The platform does not originate loans but offers investors the opportunity to fund loans initiated by other entities. PeerBerry upholds transparency by publicly publishing the financial statements of loan originators, with most undergoing financial audits.

While loan originators are licensed and equipped for risk management, detailed insights into their specific risk management strategies are not extensively disclosed. In the event of PeerBerry’s insolvency, the platform will cease to form new agreements. However, users will receive their deposited funds, and access to their transaction data will be preserved. To ensure regulatory compliance, PeerBerry plans to establish necessary data protection agreements with third-party entities.

Importantly, PeerBerry’s insolvency would not affect the legal relationships between users, loan originators, and borrowers. In such circumstances, PeerBerry is committed to arranging a third party to manage all claims on the platform and will communicate accordingly with its users. This approach reflects PeerBerry’s commitment to maintaining a secure and compliant operational environment, even in challenging circumstances.

Liquidity risk

PeerBerry addresses liquidity risk with a proactive and structured approach, crucial for its investors. The platform does not offer a secondary market, meaning investors are required to retain their loans until maturity. This absence of liquidity necessitates investor awareness regarding the immobility of funds during the loan term.

To manage potential liquidity challenges, particularly in scenarios of mass withdrawal requests, PeerBerry collaborates with its business partners to maintain reserve funds and liquidity buffers. The platform strategically accumulates a cash reserve equivalent to 10% of the total loan portfolio, ensuring the capacity for swift settlements with investors, especially in high-volume scenarios. This prudent financial planning proved instrumental during the 2020 pandemic crisis, where PeerBerry successfully managed investor withdrawals promptly and efficiently, without any delays. This strategy not only demonstrates PeerBerry’s commitment to financial stability but also reinforces investor confidence in the platform’s ability to handle liquidity effectively.

Fraud risk

Borrower fraud

PeerBerry’s approach to managing borrower fraud risk involves an extensive due diligence process. This process commences with a thorough analysis of various documents, including demographic data and credit bureau histories, and culminates in an evaluation of customer behavior. Despite these measures, PeerBerry maintains discretion regarding the disclosure of specific fraud instances and their resolution, leaving a degree of uncertainty for investors.

To mitigate the risk of borrower default, PeerBerry offers a buyback option for loans. This option aims to compensate for potential losses in such events. In scenarios where a loan originator fails to fulfill the buyback guarantee, the parent company’s Group Guarantee is activated to assume these obligations. However, it is crucial to recognize that not all parent companies possess the capability to offer such a Group Guarantee, indicating variability in the safety net available for different loans on the platform.

Platform fraud

At PeerBerry, the management of platform fraud risk is a critical consideration, particularly since investor funds are held by the platform itself. This arrangement inherently presents a potential risk, as it may enable platform managers to access and possibly withdraw investors’ funds without explicit consent. Such a scenario, while unlikely, underscores the importance of robust internal controls and oversight mechanisms to safeguard against unauthorized access and ensure the integrity of investor assets. PeerBerry’s commitment to maintaining trust with its investors hinges on effectively mitigating these risks and ensuring transparent and secure financial operations.

ESG risk

PeerBerry’s approach to Environmental, Social, and Governance (ESG) criteria is currently not extensively documented, with limited information available on the platform’s specific ESG policies and practices. This lack of detailed disclosure highlights an area for potential enhancement, particularly in the context of the growing global emphasis on sustainable and responsible investment strategies. For investors increasingly prioritizing ESG factors in their investment decisions, the expansion of transparent ESG criteria could significantly strengthen PeerBerry’s appeal and align it with contemporary investment trends.