EstateGuru – Deep Dive

Overview

Established in 2014 by Marek Pärtel and headquartered in Tallinn, Estonia, EstateGuru stands out as a leading peer-to-peer (P2P) lending platform specializing in property-backed loans for SMEs. The platform’s core mission is to bridge property financing and investment solutions in a unified marketplace, catering to both individual and business investors globally. Demonstrating impressive growth since its inception, EstateGuru has facilitated investments totaling €762 million in loans, yielding an average return of 10.49% and accruing over €72 million in investor earnings. This robust performance underscores EstateGuru’s commitment to offering lucrative and reliable investment opportunities.

Key advantage of the platform

EstateGuru, a pioneering P2P platform, prioritizes security in all its projects, guaranteeing that investors’ funds are protected in cases of borrower default. This assurance is bolstered by EstateGuru’s conservative approach to lending, with a 75% Loan to Value (LTV) threshold. This strategy not only safeguards investor interests but also provides a significant sense of security and confidence in their investment decisions.

Track records

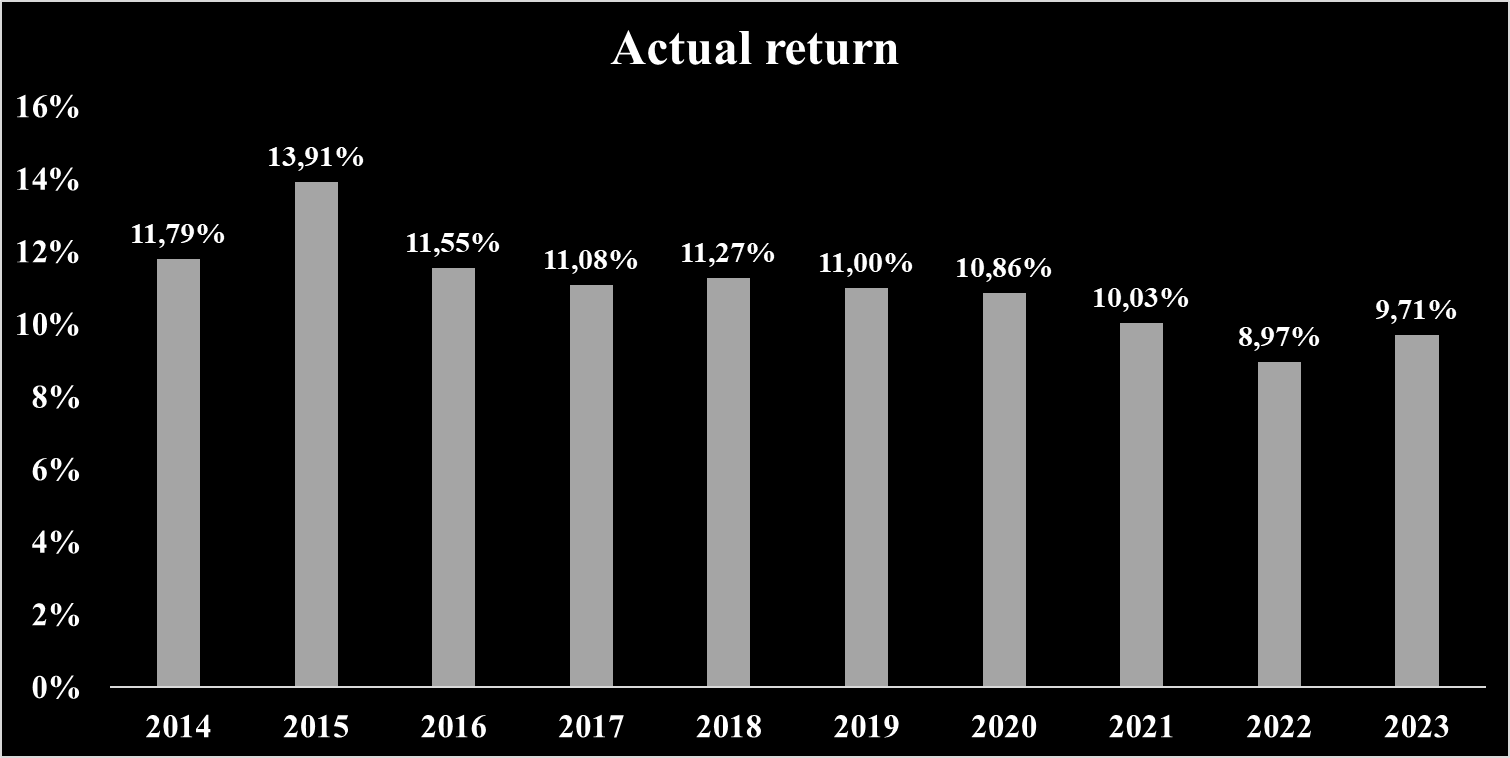

Historical returns

Default rate

No data available

Total investment on the platform per year

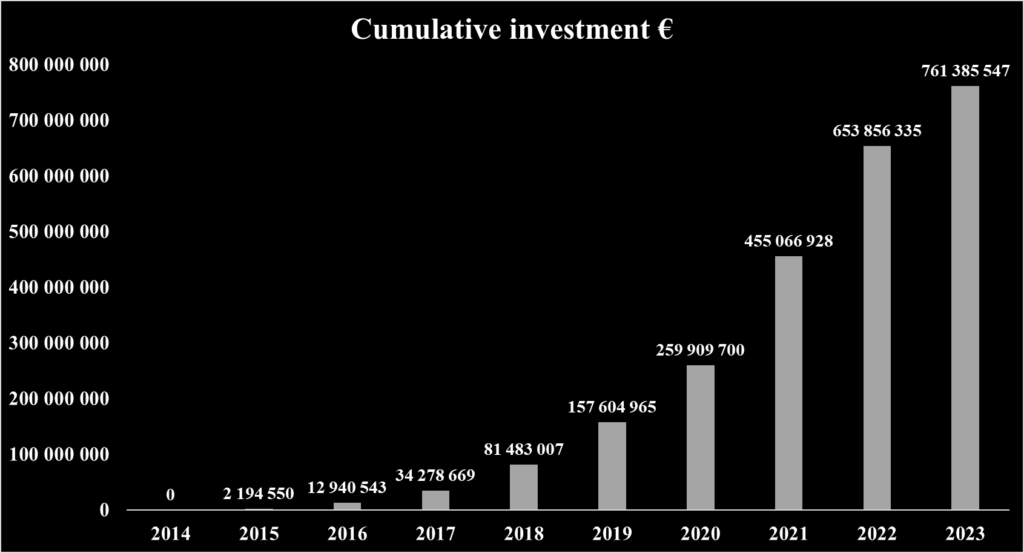

Total cumulative investment on the platform

Investment opportunities

Description of investment product

EstateGuru is a peer-to-peer (P2P) lending platform that allows individuals to invest in debt products backed by real estate assets.

The minimum amount to invest into EstateGuru’s project for investor is 50 €.

| Loan type | Bridge loan | Business loan | Bridge loan |

| Loan Type Sub-Category | Sale advance | Other | Sale advance |

| Location | Estonia | Estonia | Lithuania |

| Collateral type | Terraced house (Residential) | Recreational building (Commercial) | Residential land (Land) |

| Interest | Interest | 10,50% | 11,25% |

| Target | 576,562 € | 138,942 € | 100,000 € |

| Collateral value | 1,107,000 € | 790,000 € | 358,000 € |

| LTV | Up to 52,1% | 63,1% | 27,93% |

| Risk category | Ba1 | B3 | A3 |

| Loan Period | 12 months | 18 months | 12 months |

| Schedule Type | Full bullet | Bullet | Bullet |

| Mortgage Rank | First rank | First rank | First rank |

All projects are secured with real estate collateral, including residential properties, land and buildings under construction, as well as commercial structures like recreational buildings. A mortgage is registered against the property, and in the event of default, the lender can foreclose on the property and sell it to recoup their losses.

Investing process as a retail investor

- Account Creation: The initial step for retail investors on EstateGuru involves creating an account. This process requires submitting personal and financial details such as name, surname, email, phone number, and completing an Anti-Money Laundering (AML) verification process.

- Exploring Investment Options: Investors can then explore various investment opportunities on EstateGuru. Each project is detailed on a comprehensive page, providing insights into the project, the investment, and its schedule, aiding in due diligence.

- Investment Decision and Execution: After reviewing the investment details, investors can choose to manually select a project to fund or opt for an Auto Invest portfolio strategy.

- Investment Tracking: Post-investment, the progress of the investment can be tracked through the investor’s dashboard, offering real-time insights and updates.

- Payment Process: EstateGuru facilitates transactions in euros, supporting SEPA payments. Transactions can be made via LHV Bank, an Estonian bank specializing in real estate lending and a partner of EstateGuru. Additionally, deposits can be processed through third-party service providers like Wise Borderless, Lemonway, Revolut, and Paysera.

Team and management

EstateGuru is led by a team of real estate and fintech experts with a proven track record of consistent achievements and success.

Marek Pärtel, Co-founder of EstateGuru

Marek Pärtela seasoned entrepreneur, co-founded and currently chairs EstateGuru since October 2013, a leading marketplace in Europe for property-secured loans. His roles extend to being an investor and advisor across various organizations since 2021, and he has been an angel investor and advisor since August 2019. Pärtel has co-founded and partnered in several enterprises since 2005, and is a noted speaker in the fintech and proptech sectors since June 2014. His academic background includes studying International Business at the Estonian Business School (1996-2002) and at Stockholm University (2000).

Mihkel Stamm CEO and Member of the Board of EstateGuru

Mihkel Stammserves as the CEO and Member of the Board at EstateGuru.co since January 2023, after nearly seven years with the company, including six years as COO. His roles extend to being the Crowdfunding Area Head at FinanceEstonia since December 2019, and a Member of the Supervisory Board at SA korp! Sakala Stipendiumifond since November 2014. Stamm’s experience includes positions at Bigbank and as Head of the Estonian Sales Network. He holds a Master of Arts and a Bachelor of Arts in Psychology from Tartu Ülikool.

Judith Tan Head of Capital Markets of EstateGuru

Judith Tan is currently the Head of Capital Markets at EstateGuru.co, a role she’s held since January 2022. Her extensive experience in the real estate industry includes directorial positions at Northgate Investment Management Ltd, Lucent Group, and Fundamental Holdings Ltd, as well as being the Principal Finance Head of Originations at Investec Bank. Tan also served in capital markets roles at Commerzbank AG and Lehman Brothers, and in trading at Morgan Stanley. She is an alumna of the NYU Stern School of Business, where she studied from 1986 to 1990.

Mission and Values

EstateGuru’s mission is to revolutionize property financing and investment, offering a comprehensive marketplace that caters to both individuals and businesses worldwide. Central to EstateGuru’s ethos is a staunch commitment to transparency, ensuring investors have all necessary information for informed decision-making. The platform is built on a foundation of trust and ethical practices, fostering confidence among investors and partners. With a focus on continuous innovation, EstateGuru is dedicated to making real estate investment more accessible and affordable, while consistently striving to enhance the overall investor experience.

Trustfulness of the platform

Key investors of the company

The investors of the company is not disclosed

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Estateguru is established in Estonia and is supervised by the financial supervision authority in Estonia (Finantsinspektsioon). Estateguru is regulated in every country where it operates and applicable regulation exists. Estateguru is preparing to apply for the European Crowdfunding Regulation once the application round opens.

Estateguru’s local entities have the following licenses:

United Kingdom – FCA Crowdfunding license (obtained in 2019)

Lithuania – Crowdfunding license (obtained in 2019)

Finland – Crowdfunding license (obtained in 2020)

Germany – in process

In Estonia and Latvia no Crowdfunding regulation applies.

Fees and charges

Estateguru provides investment accounts free of charge. EstateGuru charges for Inactive account fee: 10€/monthly and for Interest spread: 0-1 %. Estateguru charges a 3% transaction fee for selling via the Secondary Market (the fee is applied to the seller) and a 1 € service fee which is calculated and charged every time an investor withdraws funds from the virtual account.

Liquidity and exit options

There is an existing secondary market that provides investors with the option to sell their investments to another EstateGuru investor. The Secondary market can be used by all investors who are involved in

EstateGuru’s investment opportunities.

Users feedback

| Trustpilot | |

| Average rate | 3/5 |

| Good review | I’m writing this review as I noticed in one of the emails the Trustpilot score was quite low, I couldn’t understand why – I see people are frustrated with some of defaulted loans, of which I hold a few, however I’m not panicking as these kind of default recoveries take time, sometimes years. Was it an error on their behalf, yes but I don’t think any investment platform is without risks – If you don’t understand long term investments that have risk, don’t invest here, or on any investment platform, including stocks and shares! If you think you are going to get 12% without any risks then you shouldn’t invest either. If you want to make 4-5% then put it in the bank and rest assured you won’t lose your money. Outlook in these types of investments is 5 years minimum to smooth out peaks and dips, dollar cost average and spread your risk. I rate this website having invested in numerous alternative investment channels. It is easy to use, reinvests your payments and allows you to spread your risk at 50 euros a time. Communication is regular and clear, I don’t want to be bombarded by details of the 200 or so different projects so monthly updates work for me. |

| Bad review | Terrible experience. Don’t put your money into this platform. Most of the loans are defaulted and the chances to get the money back is minimal. You will have your money stuck for years with no guarantee to have it back. Furthermore, the updates on default loans are ridiculous and basically all the same, regardless of the loan’s origin, whether it’s from Germany, Estonia, or Spain. This is a big scam. I invested for 1 year, and I only got a 2% return. When I tried to get back my investment, I needed to sell, but for 6 months, every 15 days, they would reject it with a message saying, ‘No one wants to purchase your shares.’ So, we can only invest and can’t get back our investment. To get back 1X, you have to wait for 10 years for a 20% return. |

Risk Analysis

Investors on this platform should be aware of specific and significant risks and familiarize themselves with the platform’s risk management strategies to safeguard their funds.

Credit risk

Borrower default risk

EstateGuru implements a rigorous due diligence process in collaboration with Moody’s, utilizing the Commercial Mortgage Metrics (CMM) model for assessing new loan projects. This model features a detailed rating scale, from Aaa (highest quality, minimal risk) to C (lowest quality, often in default). To further protect investors, EstateGuru sets a 75% Loan-to-Value (LTV) threshold, limiting loans to 75% of the property’s value.

The CMM model, a leading analytical tool in the field, evaluates the impact of market factors like vacancy rates, rents, and capitalization rates on financial metrics such as return-on-equity, debt-service-coverage, and LTV ratios. It incorporates stress testing for loss provisions and risk-adjusted yield, and uses premier commercial real estate data for property-specific forecasts. The analysis includes probability of default and loss given default models, underpinned by a comprehensive database with over 40 years of loan history.

Platform risk

Operational risk

EstateGuru rigorously safeguards investor personal data through a comprehensive security framework, encompassing legal, organizational, physical, and technical measures. Physical security includes secured office premises and locked storage for sensitive documents. Technologically, they employ password encryption, firewalls, antivirus software, regular data backups, and role-based access in their IT systems. Organizationally, they adhere to policies for data protection, information security, and access management. To ensure platform reliability, EstateGuru has backup systems and redundancies, engaging double service providers like Onfido and Veriff. Compliant with GDPR, they ensure data transfer and storage within the EEA, maintaining data processing agreements and adhering to Standard Contractual Clauses for comprehensive user data protection.

Regulatory risk

EstateGuru, a peer-to-peer platform based in Estonia, operates under the vigilant supervision of the Finantsinspektsioon, Estonia’s financial supervision authority. The platform adheres to regulations in each country where it operates, ensuring compliance with local financial laws. EstateGuru is actively working towards obtaining the European Crowdfunding Service Provider (ECSP) license, although this is not yet effective.

The platform’s local entities hold various licenses, including:

- FCA Crowdfunding license in the United Kingdom (2019).

- Crowdfunding licenses in Lithuania (2019) and Finland (2020).

- An ongoing process for licensing in Germany. Notably, Estonia and Latvia currently do not have specific crowdfunding regulations.

Platform failure

EstateGuru, functioning as an intermediary between investors and borrowers, secures its loans with real estate collateral, ensuring mortgages on the properties involved. The platform undergoes rigorous annual financial audits, currently conducted by KPMG, having previously been audited by Ernst & Young. In preparation for any potential insolvency scenarios, EstateGuru has structured its loans to cover winding-down costs, utilizing arrangement fees from these contracts. Further bolstering its contingency strategy, EstateGuru has provisions for the possible transfer of loan administration to a third-party administrator, ensuring continuity and safeguarding investor interests.

Liquidity risk

EstateGuru addresses liquidity risk effectively through its Secondary Market feature. This platform allows investors to sell their investments prematurely, providing them with enhanced liquidity options. Accessible to all participants in EstateGuru’s investment opportunities, the Secondary Market facilitates smooth transaction processes. While buyers incur no fees for utilizing this market, sellers are subject to a modest 3% transaction fee. This feature underscores EstateGuru’s commitment to providing flexible investment solutions to its user base.

Fraud risk

Borrower fraud

EstateGuru employs a rigorous due diligence process, collaborating with Moody’s, to effectively identify fraudulent loan applications. The platform’s 75% Loan-to-Value (LTV) threshold further enhances security for investors, ensuring each project is backed by real estate collateral, including residential, under-construction, and commercial properties. After full investment in a loan, the borrower formalizes the mortgage with a notary, registered in the Land Register with the Security Agent acting on behalf of investors. However, EstateGuru’s policy on non-disclosure of specific fraud incidents might create some uncertainty among investors regarding the resolution of such cases.

Platform fraud

EstateGuru implements robust safeguards against platform fraud risk. A key measure is the separation of client funds management, as EstateGuru does not directly handle investor money. Instead, the platform partners with Lemonway, a licensed payment service provider, to securely hold and manage client funds. This arrangement ensures that EstateGuru’s managers do not have direct access to investors’ funds, thereby enhancing financial security. However, it’s noted that EstateGuru does not publicly display information regarding any past instances of fraud on the platform.

ESG risk

Currently, EstateGuru’s approach to Environmental, Social, and Governance (ESG) criteria appears to be underdeveloped, with limited information available publicly. This lack of detailed ESG criteria may suggest an area for future development and transparency in EstateGuru’s platform strategy.