Bondora – Deep Dive

Overview

Bondora, established in 2008 by Pärtel Tomberg and based in Tallinn, Estonia, stands as a pioneering force in the peer-to-peer (P2P) lending landscape and a leading digital consumer loan provider in Continental Europe. The platform specializes in offering fully digital consumer loans to residents of Finland, Spain, and Estonia. With a core mission to democratize the lending and investing process, Bondora makes financial opportunities accessible to a broad audience. Since its inception, Bondora has garnered a substantial investor base, with over 226,000 individuals investing more than €880 million and earning a collective €111 million in returns, highlighting its significant impact in the financial sector.

Key advantage of the platform

Bondora, a prominent peer-to-peer (P2P) lending platform, offers two distinct investment options: Go & Grow and Go & Grow Unlimited. These products allow for automated management of investments in consumer unsecured loans, providing a hassle-free experience for investors. Committed to transparency, Bondora features an extensive Q&A section on its website, alongside a wealth of documents including project reports, financial statements, and insightful articles. Additionally, Bondora offers an API, enabling investors to access in-depth data, thereby facilitating comprehensive due diligence. A standout feature of Bondora’s investment offerings, Go & Grow and Go & Grow Unlimited, is their liquidity. Investors have the flexibility to cash out their invested amounts as needed, ensuring ease of access to their funds.

Track records

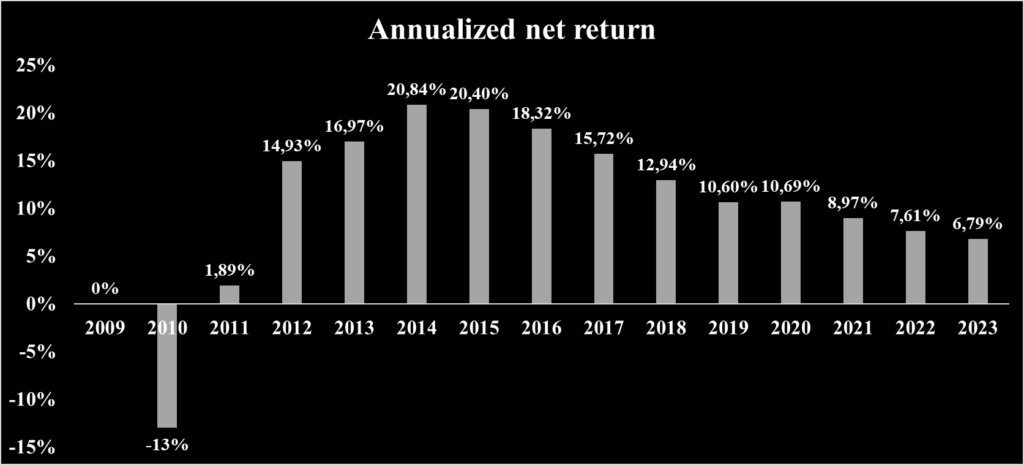

Historical returns

Net return

Default rate

Data is not available

Total investment on the platform per year

Data is not available

Total cumulative investment on the platform

Data is not available

Investment opportunities

Bondora is a peer-to-peer (P2P) lending platform that allows individuals to invest in consumer loans. The minimum amount to invest into Bondora’s project for investor is 1 €.

| Go & Grow | Go & Grow Unlimited | |

| Target Returns | 6,75% | 4% |

| Types of loan | Unsecured loan | Unsecured loan |

| Withdrawal Fees per transacation | Automated Features | Automated Features |

| Features | Automated Features | Automated Features |

| Level of experienced | Ideal for beginners | Ideal for beginners |

| Management fees | No management fees | No management fees |

| Maximum investable amount per year | 700 € x 12= 8400 € | Unlimited |

Bondora investments are not guaranteed because they are unsecured loans.

Investing process as a retail investors

- Account Creation: The first step for potential investors on Bondora is to create an account. This process involves submitting personal and financial details, including name, surname, email, phone number, ID card, and undergoing the KYC verification process.

- Funding the Account: Investors can deposit funds into their Bondora account via bank transfer. These funds are managed by PHV Pank, the designated payment service provider, enhancing the security of investors’ money. Importantly, Bondora does not hold client funds, significantly reducing the risk of financial loss in case of platform issues.

- Exploring Investment Opportunities: Investors on Bondora currently have the option to invest in the ‘Go & Grow’ product. This opportunity is tailored for new investors, offering a streamlined investment experience.

- Investment Monitoring: After investing, individuals can track the progress of their investments directly through their Bondora accounts.

- Currency Requirements: Bondora operates exclusively in Euros (€). Therefore, all payments to Bondora must be made in this currency, as any payments made in other currencies will be rejected by the bank.

Team and management

Bondora is led by a team of financial and managerial experts with a proven track record of consistent achievements and success.

Pärtel Tomberg, CEO & Founder Bondora

Pärtel Tomberg, CEO and Founder of Bondora, has a dynamic background in finance and technology. Leading Bondora since 2007, he has focused on creating accessible financial products. Tomberg was a Business Development Director at Halens AB (2009-2011), integrating the CEE unit of Quelle AG. He also worked at Cleveron Ltd. and Oxford Entrepreneurs, developing a business start-up support scheme. Earlier, he managed operations at Quelle across four countries. Academically, Tomberg completed an Executive Program at Stanford University Graduate School of Business (2022) and holds a BA (Hons) in International Business Management from Oxford Brookes University.

Rauno Klettenberg, Bank CEO of Bondora

Rauno Klettenberg, the Bank CEO of Bondora since November 2022, has an extensive background in the Nordic-Baltic financial sector. His expertise spans banking, financial markets, corporate finance, and risk management. He was the CEO of Holm Bank AS (2019-2022) and led Transaction Advisory Services at EY Estonia (2018-2019). Klettenberg also served at Nasdaq, including as Chairman of the Estonian CSD Board (2013-2017), and held key positions at Svenska Handelsbanken and SEB. Academically, he holds a Master’s in Accounting and Finance and a Bachelor of Business Administration from the Estonian Business School, complemented by Board Member Education from the Baltic Institute of Corporate Governance (2022).

Jaak Erm, CRO of Bondora

Jaak Erm, the Chief Risk Officer of Bondora since November 2022, has a rich history in risk management. He served as the Chief Risk Officer of Paywerk from June 2021 to November 2022 and was the Head of Credit & Risk at IPF Digital from January 2012 to June 2021. Earlier, he was the Head of Credit Risk at UniCredit from 2007 to 2012, a Credit Analyst at SEB from 2004 to 2007, and held the same position at Krediidiinfo AS Creditinfo Estonia from 2003 to 2004. Academically, Erm earned a Master of Arts in Business Administration and Management from the Estonian Business School, completed Master courses at SDA Bocconi in 2006, and obtained a Bachelor’s degree in Economics from TalTech – Tallinn University of Technology in 2003.

Mission and Values

Bondora, with its mission rooted in democratizing lending and investing, emphasizes transparency, fairness, simplicity, innovation, and customer focus. These core values intertwine to foster a sustainable and trustworthy marketplace. At the heart of Bondora’s philosophy is the drive to make lending and investing straightforward and accessible, achieved through continuous innovation and a commitment to simplicity. This approach not only empowers investors but also establishes a solid foundation of trust and transparency within its community.

Trustfulness of the platform

Key investors of the company

| Valinor Management LLC | Global Founders Capital | |

| Asset Management | 3,22 billion € | 2,46 billion € |

| Date of creation | 2007 | 2013 |

| Founder | David Gallo | Oliver Samwer |

| Website | https://whalewisdom.com/ | https://www.globalfounderscapital.com/ |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Bondora is licensed as a credit provider by the Estonian Financial Supervision Authority (FSA), the primary regulatory body in Estonia. In addition, Bondora AS is regulated by the regulators in Finland.

Fees and charges

Investing with Bondora comes at no cost for investors. There are no fees for opening an account, making deposits, or managing fees. The only fee applies to withdrawal transactions, which is 1 € per transaction.

Liquidity and exit options

Liquidity is available on the Bondora platform through the investment options of Go & Grow and Go & Grow Unlimited. Investors have the freedom to withdraw their funds at any moment and at any time.

Users feedback

| Trustpilot | |

| Average rate | 3,8/5 |

| Good review | My daughter who has been investing with bondora for a long time recommended bondora to me. The first month I invested 100 euros and saw that it grew with a high return. So every month I deposit money into my account. Excellent investment friendly operators and fast assistance with very good 6.75% return I am very happy and enthusiastic. |

| Bad review | The average interest rate is very low compared to other platforms. The product is currently lacking refinement and clarity. It would greatly benefit from the oversight of a more effective product management team, possibly even multiple individuals. My experience with it has left me quite disappointed. |

Risk Analysis

Investors utilizing this platform need to be mindful of particular, substantial risks and should understand the platform’s risk management strategies to protect their funds.

Credit risk

Borrower default risk

Bondora employs a meticulous due diligence process for borrower default risk management, utilizing the Bondora Rating credit scoring system. This system categorizes loans into seven grades, from AA (lowest risk) to F (highest acceptable risk for the marketplace). The risk evaluation model operates on two levels:

- Micro Level Assessment: This level incorporates parameters like probability of default (PD), loss given default (LGD), exposure at default (EAD%), and duration (M). These metrics consider various factors, including the borrower’s country, credit history, and other relevant criteria.

- Macro Level Analysis: Here, the model evaluates broader economic factors, accounting for unexpected risks and country-specific factors that could influence lending.

Data for these analyses is derived from three sources: internally collected data, which is publicly accessible; external data compared against other databases; and behavioral data based on user interactions on Bondora’s website. This comprehensive approach to data utilization underpins Bondora’s strategy for evaluating and mitigating loan-associated risks.

Platform risk

Operational risk

Bondora Group prioritizes the security of its computer systems, software, networks, and the confidentiality of customer data through continuous system enhancements. The platform implements advanced security measures, including encrypted data transmission using technologies from licensed third-party providers. Bondora regularly undergoes penetration testing by cybersecurity experts to proactively identify and mitigate vulnerabilities. A robust 2-factor authentication process is enforced for transactions and account modifications, incorporating an SMS PIN code verification step for withdrawals. The network and server infrastructure, hosted by Virtion GmbH in Germany, feature primary and backup centers in different locations, ensuring operational reliability. Virtion’s adherence to the ISO 27001 standard reaffirms its commitment to maintaining high IT security standards.

Regulatory risk

Bondora, a peer-to-peer (P2P) lending platform based in Estonia, adheres to the regulatory framework set by the Estonian Financial Supervision Authority, holding a credit provider license. Additionally, Bondora AS is under regulatory oversight in Finland, aligning with local financial regulations. However, as of now, there has been no specific disclosure from Bondora regarding the adoption of the European Crowdfunding Service Provider (ECSP) regulation, which is mandatory for European crowdfunding companies by November 2023. This lack of information on ECSP implementation is a notable aspect of Bondora’s regulatory compliance status.

Platform failure

Bondora prioritizes accountability and the reliability of its platform, implementing robust measures to mitigate platform failure risk. Regular audits conducted by KPMG Estonia play a crucial role in ensuring compliance, verifying the accuracy and authenticity of Bondora’s financial statements. Additionally, internal audit processes are rigorously overseen by Erki Mägi from AS PricewaterhouseCoopers, who reports directly to the Supervisory Board, ensuring the integrity of internal controls and procedures. Demonstrating its commitment to transparency and reliability, Bondora maintains a comprehensive business continuity process, rigorously overseen by its Management Board. This process, reviewed and approved annually, is designed to align with established continuity plans, thereby safeguarding the platform’s operational stability.

Liquidity risk

Bondora adeptly manages its liquidity risk, particularly highlighted by the offerings of Go & Grow and Go & Grow Unlimited, both designed to provide unlimited liquidity for investors.

The primary challenge lies in managing the platform’s liquidity. To this end, Bondora utilizes a centralized treasury system for effective liquidity risk management, encompassing vigilant daily tracking of cash balances and regular six-month cash flow forecasting. This strategic approach ensures a robust and comprehensive management of liquidity.

To further bolster its financial stability, Bondora received a €4.5 million equity injection in January 2015. In scenarios of heightened withdrawal demands, such as the unprecedented surge during the 2020 pandemic, Bondora has employed a partial payout system, enabling gradual withdrawals for customers. This measure, indicative of Bondora’s proactive risk management, ensures the platform’s resilience and reliability in managing liquidity under varying market conditions. Bondora’s liquidity risk management strategy is under continuous evaluation, maintaining a strong focus on daily cash balance monitoring and periodic cash flow forecasting.

Fraud risk

Borrower fraud

Bondora leverages a sophisticated proprietary credit modeling system, designed for the precise identification of fraudulent loan applications. This system meticulously analyzes a comprehensive array of data points, enhancing the reliability of fraud detection. In addition, Bondora enforces stringent borrower requirements, including the submission of personal identification and residential address details, and conducts thorough checks against national debt registries. To further strengthen its fraud detection capabilities, Bondora collaborates with third-party services, notably partnering with Onfido in 2020. Onfido, recognized for its robust online identity verification service, aligns with KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, contributing significantly to Bondora’s commitment to maintaining a secure and trustworthy lending environment.

Platform fraud

In the case of Bondora, the risk of managerial misappropriation of investor funds is effectively mitigated, as the platform itself does not directly handle client funds. Instead, these funds are securely held by LHV Pank, ensuring a clear separation that prevents managers from accessing investors’ capital. Reinforcing this security, Moody’s Service recently reaffirmed the investment-grade credit rating of AS LHV Pank, maintaining a stable outlook consistent with the previous year’s assessment. This external validation by Moody’s underscores the financial stability and trustworthiness of the custodian bank, further assuring investors of the safety of their investments on the Bondora platform.

ESG risk

Currently, detailed information on the Environmental, Social, and Governance (ESG) criteria implemented by Bondora is limited. This scarcity of ESG-specific disclosures on the platform indicates an area for potential development, particularly in an investment landscape increasingly focused on sustainability and ethical practices. Enhancing ESG transparency could further align Bondora with evolving investor priorities and global trends towards responsible investing.