Crowdestor – Deep Dive

Overview

Crowdestor stands out as a dynamic peer-to-peer (P2P) crowdfunding platform, established at the end of 2017 by Timma Jānis and Ūdris Gunārs. Headquartered in Tallinn, Estonia, Crowdestor offers a unique opportunity for investors to engage in a diverse array of business projects across sectors such as Energy, Film Production, Real Estate, Restaurants, and Forestry. The platform’s primary mission is to champion businesses by unlocking new avenues for investment, thereby fostering growth across various industries and regions. Since its inception, Crowdestor has garnered significant traction, with over 27,000 investors entrusting the platform to fund projects exceeding 57 million €. This reflects Crowdestor’s growing reputation as a reliable and versatile investment platform.

Key advantage of the platform

Crowdestor distinguishes itself as a peer-to-peer (P2P) platform, presenting investors with a spectrum of European project investment opportunities. The platform’s offerings stand out for their security, as loans are often backed by a range of guarantees, including personal assurances, commercial pledges on equity, and collaterals like real estate, intellectual property, and mortgages.

A hallmark of Crowdestor is its commitment to transparency. This is exemplified on their website, where a detailed Q&A section offers in-depth insights into their operations. Furthermore, they provide accessible and comprehensive documentation, including thorough project reports and insightful articles, fostering an environment of openness and informed decision-making for their investors.

Track records

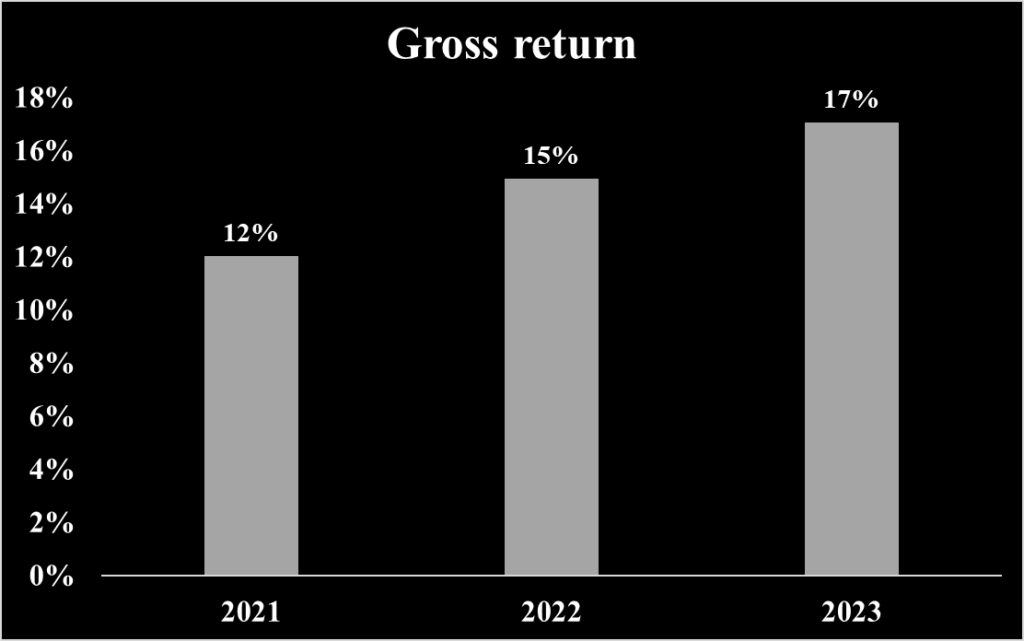

Historical returns

Default rate

Data is not available

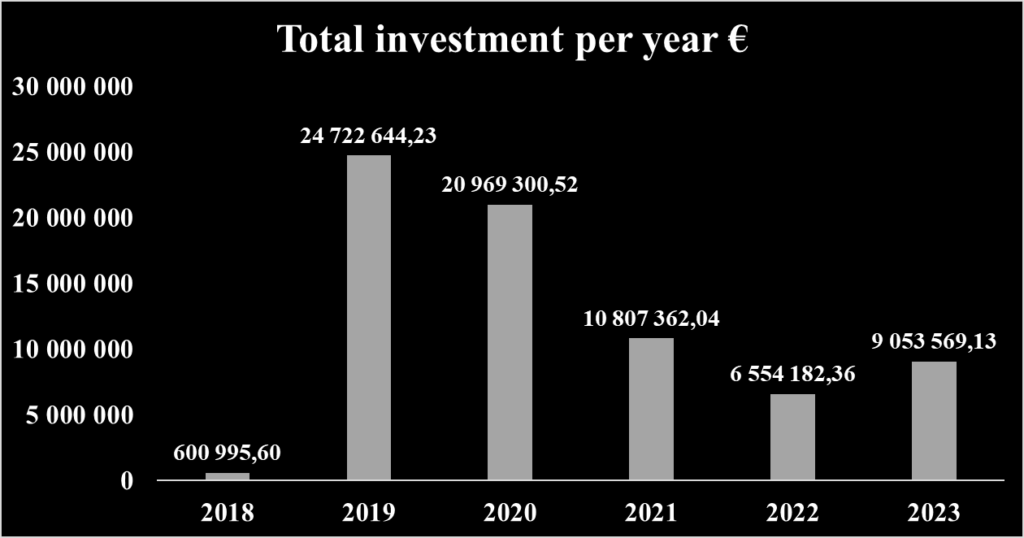

Total investment on the platform per year

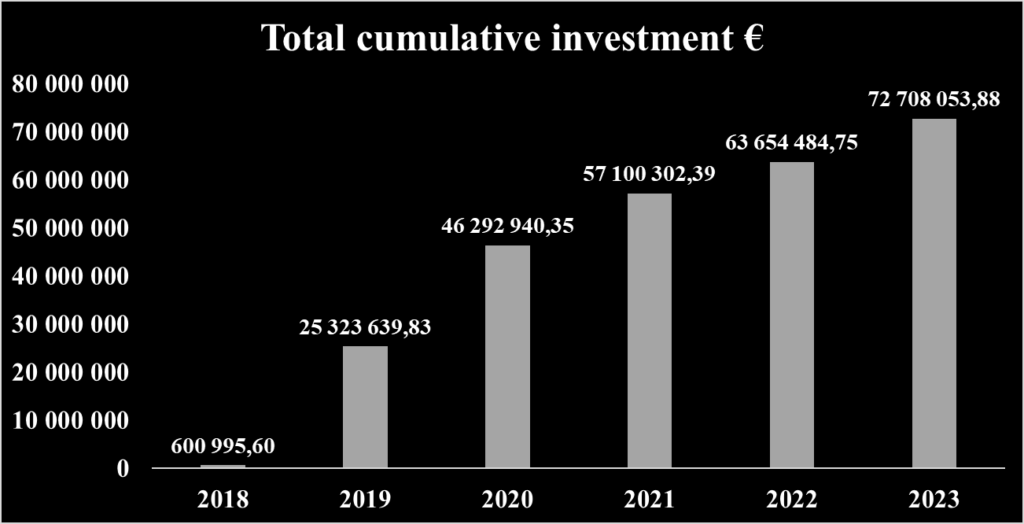

Total cumulative investment on the platform

Investment opportunities

Crowdestor is an online crowdfunding platform that allows individuals to invest in business projects in various industries. The minimum amount to invest into Crowdestor’s project such as Energy, movie production, real estate project, restaurants, forestry for investor is 50 € and the minimum amount to invest into Crowdestor’s project such as consumer loan is 10 €.

| Target | 13 411 € | 50 000 € | 67 984 € |

| Opens | 20/06/2022 | 21/03/2022 | 20/06/2020 |

| Expires | 04/07/2022 | 21/04/2022 | 20/07/2020 |

| Type | Real estate | SME | Specialized |

| Location | Latvia | Latvia | Latvia |

| Period | 12 months | 18 months | 12 months |

| Interest rate | 30% | 25% | 30% |

| Maximum target | 36 000 € | 50 000 € | 85 000 € |

| Repayment | The interest and the loan principal are repaid at the end of the Loan Term in a bullet payment. | Interest payments are paid monthly. Loan principal – repaid monthly in similar installments, from the 6th month. | Interest payments are paid in bullet payments together with the Loan principal payment at the end of the Loan term. |

| Collateral | Private guarantee from SIA SPADE | A personal guarantee from the company’s member of the board, Beneficial owner of the company | Stock of the assets |

The loans offered by the Crowdestor platform can be guaranteed with personal guarantees, commercial pledges on equity, real estate, intellectual property, and mortgages. Additionally, until December 31, 2021, there was a Provision Fund set up by Crowdestor with an initial investment of 50,000 EUR to protect investors from defaults.

Investment opportunities

- Account Creation: The investment journey on Crowdestor begins with the creation of an investor account. This initial step requires investors to provide essential personal and financial details, including their name, surname, email, phone number, and ID card information, ensuring a secure and personalized investing experience.

- Project Assessment: Investors are then invited to explore Crowdestor’s diverse range of investment options. The platform offers a detailed overview of each project, enabling efficient and informed due diligence. Every investment opportunity is meticulously detailed on individual webpages, providing comprehensive insights about the associated company and the specifics of the investment.

- Investment Decision: After a thorough review of the investment details, investors can make an informed decision. Crowdestor facilitates a flexible investment approach, allowing investors to either manually select specific loans or utilize the Auto Invest feature to automate their portfolio strategy according to predefined criteria.

- Investment Monitoring: Post-investment, investors can conveniently track the progress of their investments through their Crowdestor accounts. The platform ensures regular updates are provided, keeping investors informed about the ongoing status and developments of the projects they have invested in.

- Payment Methods: Crowdestor accommodates a variety of payment methods for added convenience. This includes bank transfers and the use of popular payment service providers such as Revolut, Wise, and Paysera. It’s important to note that Crowdestor only accepts SEPA payments, aligning with its focus on facilitating transactions within the Single Euro Payments Area.

Team and management

Jānis Timma, CEO & and Co-Founder of Crowdestor

Jānis Timma, CEO and Co-Founder of Crowdestor, has been a key figure in the finance and energy sectors since 2017. He also leads Eco Energy Riga and the Heat and Power Plant Association of Latvia, showcasing his expertise in energy management. Timma’s background includes roles at BDO and PwC, highlighting his experience in financial management. Academically, he studied Finance and Financial Management at Latvijas Universitate and Legal Studies at Biznesa augstskola Turība, equipping him with a comprehensive skill set for his entrepreneurial ventures.

Gunars Udris, Co-Founder of Crowdestor

Gunārs Ūdris, Co-Founder of Crowdestor, has been instrumental in the platform’s growth since December 2017. He also served as Managing Partner at FUNDEA and held a Project Manager role at HH Rent. Earlier, he was CEO of DO. Ūdris holds a Bachelor’s degree in Political Science and Government from Latvijas Universitate. His diverse experience in management and strategic planning contributes significantly to Crowdestor’s success.

Mission and Values

Crowdestor’s mission is centered on fostering business growth and presenting investors with distinctive, financially robust opportunities that span a diverse range of industries and geographic regions. At the heart of Crowdestor’s ethos is a commitment to simplicity, ensuring that every transaction on the platform is intuitively accessible for investors. Transparency is a cornerstone of their operations, evidenced by the provision of comprehensive summaries of borrowers’ business cases, complete with detailed financial information.

Furthermore, Crowdestor’s dedication to professionalism is manifest in their meticulous approach to due diligence for each business case. This commitment extends to maintaining a responsive and attentive relationship with each investor, reinforcing Crowdestor’s standing as a platform that values clarity, ease of use, and unwavering professional integrity.

Trustfulness of the platform

Key investors of the company

Data not available

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Crowdestor is operating under the jurisdiction of Estonian Law. Crowdestor is currently working towards obtaining the ECSP, but it has not yet received validation.

Fees and charges

Investors cost

Investing with Crowdestor comes at no cost for investors. There are no fees for opening an account, making deposits, or managing fees. The only fee applies to projects of type FLEX with withdrawal transactions, and it amounts to 1 € per transaction. Bank link transfers accroding to service providers pricing.

Secondary market

The seller’s commission: Investors who want to sell a loan have to pay a flat fee of 2% (calculated and deducted from the loan deal price).

The buyer’s commission: Depends on the discount. The discount is the ratio of the outstanding principal to the asking price. If the price is lower than the outstanding principal, the following commission structure will apply:

• discount ≤ 10%, the fee will not apply to the buyer.

• discount ≥ 10% (for example, X), then the fee will be 10% of the difference between X and 10%, but not higher than 2%.

Liquidity and exit options

There is an existing secondary market that provides investors with the option to sell their investments to another Crowdestor investor before the investment’s maturity date.

Users feedback

| Trustpilot | |

| Average rate | 2,6/5 |

| Good review | I’ve been with them for several years and this is my experience: Of the projects I’ve been involved in, 80% are paid for, 20% are overdue. Flex’s projects are quite good and provide an acceptable daily return.They’ve been through some rough times (like all of us). I think they intend to provide the best possible service. I’ve always been answered. |

| Bad review | The real estate loans should be relatively safe, but even those investments are not repaid. I am waiting more than 2 years for repayment or even some update on why there is a delay. Nothing Cannot recommend this platform, and I am only glad I didn’t invest any real money, just a couple of investments to test it out before investing more. |

Risk Analysis

Investors using this platform should be conscious of specific significant risks and grasp the platform’s risk management strategies to safeguard their funds.

Credit risk

Borrower default risk

Crowdestor employs a sophisticated credit scoring system to meticulously assess the creditworthiness of potential borrowers. This system assigns a credit score ranging from 0 to 1000, with a threshold of 551 or a risk rating of C required for funding eligibility on the platform.

Financial Factors (50% Weight): The credit risk scoring model analyzes annual accounts, focusing on profitability, leverage, liquidity, coverage, and activity aspects, such as gross margin and debt/equity ratio. These metrics provide insights into the financial health of applicants, influencing their credit scores, credit limits, and interest rates on the platform. Additionally, the model incorporates bank account statement information to gain a current perspective on the company’s financial position and cash-flow behavior, accounting for 10% of the overall model weight.

Non-Financial Factors (50% Weight): This part of the model integrates critical non-financial factors. It considers macroeconomic conditions, industry trends (5% weight), and the personal credit history of the borrower’s management representative (35% weight), evaluating their payment history and financial responsibility. Furthermore, the model takes into account the management’s business operation experience (10% weight), as this significantly reflects the borrower’s ability to meet financial obligations.

Crowdestor’s comprehensive approach to credit risk assessment combines both financial and non-financial factors to provide a well-rounded evaluation of each borrower’s creditworthiness. This process not only ensures the platform’s financial integrity but also safeguards investor interests by facilitating informed investment decisions.

Platform risk

Operational risk

Crowdestor rigorously safeguards its technological infrastructure, emphasizing robust security measures to protect its platform and customer data. The core of Crowdestor’s security strategy includes:

- Infrastructure Security: Their system infrastructure is robustly designed with virtual machines, ensuring redundancy with duplicated databases and routine backups, thereby fortifying data integrity.

- Advanced Firewall and Encryption: Modern firewall technologies are employed to shield their code and data. Passwords are encrypted for enhanced security, and only HTTPS connections are supported. This applies both within their internal network and in interactions with service providers, ensuring secure data transmission.

- Data Breach Prevention: Proactive steps are taken to prevent data breaches. This includes mandatory customer verification through Veriff, incorporating Face ID and document verification processes. Such measures significantly bolster the platform’s defenses against unauthorized access.

- Data Privacy and Storage: All personal data collected from customers is securely stored within Crowdestor’s firewalled network. Strict protocols are in place to prevent unauthorized access to users’ personal information, aligning with the highest standards of data protection.

- Continuous Monitoring: Crowdestor conducts daily monitoring to gather analytics on potential security breaches and hacking attempts, ensuring a prompt response to any threats.

Crowdestor’s commitment to operational security is unwavering, with these rigorous practices playing a pivotal role in maintaining the platform’s integrity and the trust of its users.

Regulatory risk

Crowdestor, positioned as a notable peer-to-peer (P2P) platform, is firmly rooted in Estonia and diligently adheres to the country’s regulatory framework. The platform is cognizant of the evolving regulatory landscape and is actively engaged in the process of acquiring the European Crowdfunding Service Provider (ECSP) license. This pursuit underscores Crowdestor’s commitment to compliance and its dedication to aligning with broader European standards. As of now, the validation for the ECSP license is in progress, reflecting Crowdestor’s dedication to upholding regulatory excellence and ensuring a secure, compliant environment for its users.

Platform failure

Crowdestor functions primarily as an intermediary, facilitating connections between investors and borrowers. In this capacity, Crowdestor does not originate loans directly but rather provides a robust platform enabling investors to finance loans initiated by various companies. As of now, Crowdestor has not publicly disclosed detailed procedures for handling potential insolvency scenarios. This absence of information on insolvency protocols highlights an area where greater transparency could enhance investor confidence and preparedness for unforeseen financial challenges. The clarification of such procedures would be a valuable addition to Crowdestor’s comprehensive service offerings, ensuring stakeholders are well-informed about the platform’s contingency plans in the event of operational difficulties.

Liquidity risk

Crowdestor’s approach to liquidity risk management is highlighted by its versatile Secondary Market feature. This platform allows investors the opportunity to sell their loans to other Crowdestor participants, offering enhanced liquidity options. Sales can be made at either a discount or premium, depending on the investor’s strategy and market conditions.

For investors seeking early exits from loans, perhaps due to perceived increases in default risk, Crowdestor’s Secondary Market provides a viable solution. However, it’s important to note that certain prerequisites must be satisfied for these transactions to be successful. Primarily, this involves securing another investor willing to purchase the loan.

In terms of transaction fees, Crowdestor imposes a flat 2% fee on sellers as a commission for facilitating these sales. Buyers’ commission rates are variable and are influenced by the discount level applied to the loan deal. This structure aims to balance the interests of both parties involved in the transaction, maintaining a fair and efficient marketplace for all users.

Fraud risk

Borrower fraud

Crowdestor implements a robust credit scoring system to meticulously evaluate the creditworthiness of potential borrowers. This system is pivotal in assessing various aspects of a borrower’s profile, including an analysis of bank statements from the past 12 months, a detailed project description, and the purpose of the loan. Despite these measures, Crowdestor maintains discretion regarding the disclosure of specific fraud instances and their resolution, a practice that may lead to investor uncertainty.

To mitigate default risks for its investors, Crowdestor established the Provision Fund program. This fund, initially seeded with €50,000 by Crowdestor, was designed to cover projects financed before December 31, 2021. However, it’s crucial to note that loans acquired post-December 31, 2021, are excluded from this protective mechanism.

In terms of borrower guarantees, Crowdestor offers borrowers the option to secure loans with varied forms of collateral, including personal guarantees, commercial pledges on equity, real estate, intellectual property, and mortgages. Additionally, a BuyBack Obligation feature is available for certain loans, providing an added layer of security for investors. This obligation is clearly indicated on the loan’s specific view page, ensuring transparency and informed decision-making for platform users.

Platform fraud

Crowdestor, like any financial platform, is not immune to the risk of fraud, particularly given its custodial role over funds. To address this, Crowdestor has instituted a clear demarcation between investor funds and operational finances. Investor monies are maintained in a distinct bank account, a measure designed to bolster security and ensure proper fund management.

Despite these safeguards, the possibility of unauthorized fund access by management remains a consideration. This scenario underscores the importance of vigilance and robust internal controls within Crowdestor’s operational framework.

As of now, Crowdestor has not publicly detailed any specific instances of fraud on its platform. This lack of disclosure may prompt calls for greater transparency among investors, who often seek comprehensive understanding of a platform’s historical integrity and its approach to handling potential fraud cases. Enhanced clarity in this aspect could significantly reinforce investor trust in Crowdestor’s commitment to ethical practices and secure fund management.

ESG risk

Crowdestor’s approach to Environmental, Social, and Governance (ESG) criteria remains an area where information is notably sparse. The platform currently provides limited insight into its ESG policies and practices, leaving a gap in understanding for investors who prioritize these factors in their investment decisions. This lack of detailed disclosure on ESG considerations suggests an opportunity for Crowdestor to enhance its transparency and align with the growing investor focus on sustainability and ethical practices. By addressing this area and providing clearer information on ESG criteria and initiatives, Crowdestor could significantly bolster its appeal to a broader, more socially-conscious investor base.