Esketit – Deep Dive

Overview

Esketit, a cutting-edge peer-to-peer (P2P) lending platform, was established in December 2020 by Davis Barons and Matiss Ansviesulis, the visionaries behind AvaFin Holding, formerly known as Creamfinance. Headquartered in Dublin, Ireland, Esketit’s core mission is to provide a secure and intuitive platform for investors seeking lending opportunities to businesses and individuals across Europe. Since its inception in 2020, Esketit has rapidly gained traction in the P2P lending market, with investors having committed over €360 million, resulting in more than €5 million in interest earnings. This impressive growth underscores Esketit’s commitment to offering effective investment solutions and building a robust financial community.

Key advantage of the platform

The platform fortifies investor confidence through its BuyBack and Group Guarantees. These features offer a robust safety net against borrower defaults, presenting a dual-layered security mechanism that underscores Esketit’s commitment to investor protection. Esketit’s dedication to openness is exemplified by its regular publication of management presentations for the Creamfinance Group and the auditing of annual reports in accordance with IFRS standards. This transparency empowers investors with essential insights for informed decision-making.

Track records

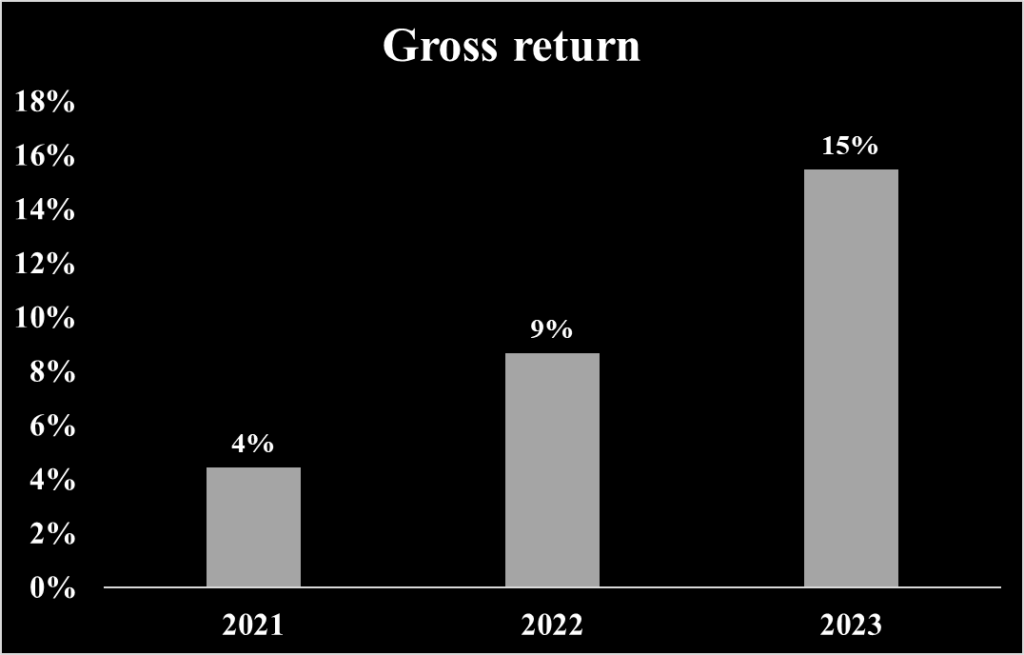

Historical returns

Default rate

Data is not available

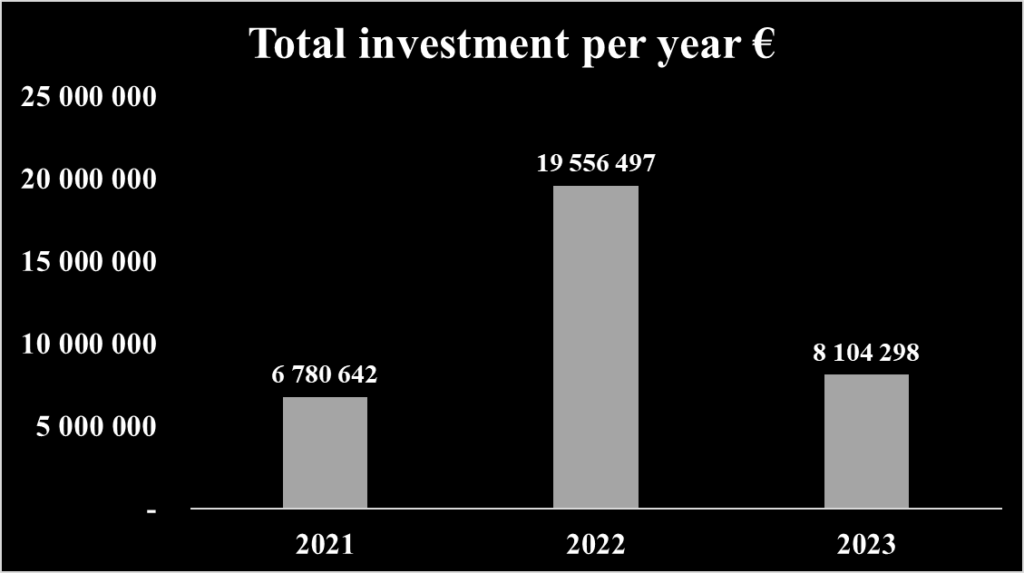

Total investment on the platform per year

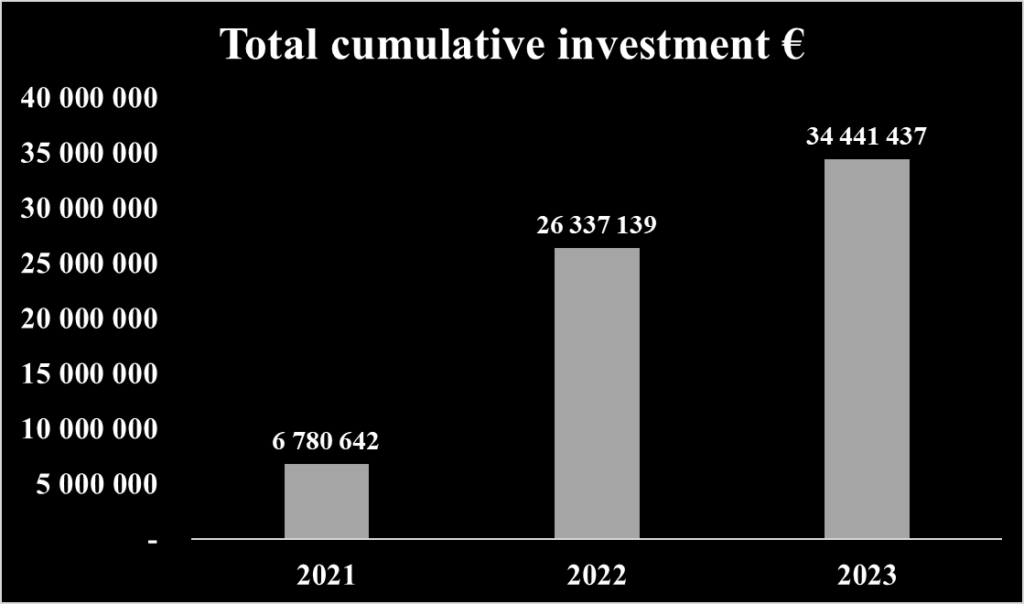

Total cumulative investment on the platform

Investment opportunities

Esketit is a P2P lending platform that allows individuals or corporates to invest in short-term consumer loan in multiple countries. The minimum amount to invest into Esketit’s project for investor is 10 €.

| Type loan | Loan ID 1541030473 | Loan ID 1541108227 | Loan ID 1541109772 |

| Interest rate | 12% | 12% | 12% |

| Remaining balance | 61,61 € | 315,45 € | 489,72 € |

| Remaining loan term | 20 days | 30 days | 60 days |

| Already funded | 204,03 € | 16,60 € | 41,56 € |

| Loan type | Short term loan | Short term loan | Short term loan |

| Loan originator | Money for finance JO | Money for finance JO | Money for finance JO |

| Country | Jordan | Jordan | Jordan |

| BuyBack obligation | Yes, loan has Buyback obligation | Yes, loan has Buyback obligation | Yes, loan has Buyback obligation |

| Date of issue | 11/01/2023 | 01/11/2023 | 01/11/2023 |

| Closing date | 21/11/2023 | 01/12/2023 | 31/12/2023 |

All loans offered on the platform are backed by a repurchase guarantee provided by the loan originator. In cases where a loan originator can’t fulfill this guarantee, a Group Guarantee comes into play, with the parent company covering the obligations. It is important to note that not all parent companies offer a Group Guarantee.

Investing process as a retail investors

- Account Creation: The first step for investors on Esketit is to create an account. This process requires providing essential personal and financial details such as name, surname, email, and phone number.

- Exploring Investment Options: Investors can then explore a diverse range of investment opportunities on Esketit. The platform presents detailed information on each project, facilitating swift due diligence.

Each investment is highlighted on a dedicated page, offering in-depth insights into the loan originator company and the specifics of the investment. - Investment Decision and Process: After evaluating the investment details, investors can proceed to request an investment. Esketit offers the flexibility to either manually select loans or to utilize an Auto Invest strategy for portfolio diversification.

- Currency and Payment Options: The primary currency on Esketit is the Euro (EUR), and the platform accepts payments in this currency. Uniquely, Esketit also accommodates deposits in crypto stablecoins, currently supporting USDC and USDT on the Ethereum blockchain.

- Investment Monitoring: Following their investment, investors can monitor the performance of their investments through their Esketit accounts. Regular updates on the invested projects are provided, keeping investors well-informed about the progress and performance of their investments.

Team and management

Esketit is under the guidance of a team of financial and managerial expert who have demonstrated a consistent history of achievements and success.

Davis Barons, Co- Founder of Esketit

Davis Barons is a seasoned entrepreneur and the Co-Founder of Esketit, with a notable role as the Chairman of Creamfinance, a consumer finance services provider in Europe. His leadership journey includes being the CEO of Green Fortune Latvia, focusing on urban greening solutions. Barons is active in finance industry associations, contributing to sustainable market practices. Academically, he holds a Bachelor’s degree in Environmental Science from Riga Technical University and has completed executive education programs in corporate finance and value creation at INSEAD and a venture capital program at the University of California Berkeley Haas School of Business.

Matiss Ansviesulis, Co-Founder of Esketit

Matiss Ansviesulis, the co-founder of Esketit and Creamfinance, is recognized for scaling Creamfinance into a leading online consumer lender in Europe. He also co-founded mojobank.app and LoanMe Sri Lanka. Previously, he served as a Money Market Trader at J.P. Morgan. Ansviesulis holds a Venture Capital Executive Program certificate from the University of California Berkeley Haas School of Business and a BSc (Hons) in Business Studies from Lancaster University. He completed his high school education with a focus on Mathematics at Riga State Gymnasium Nr. 1.

Vitalijs Zalovs, CEO of Esketit

Vitalijs Zalovs is the CEO of Esketit, a role he has held since April 2021, where he oversees a platform for global investment in consumer loans. He is also an angel investor with BADideas.fund, focusing on startups in Central and Eastern Europe and CIS. Previously, Zalovs spent six years at Mintos, including a tenure as Head of Investor Service, and worked at Nordea in roles related to cash management and customer service. He holds a degree in Accounting and Finance from Banku Augstskola, completed between 2014 and 2017.

Mission and Values

Esketit’s mission is rooted in democratizing financial access and empowering individuals to achieve their financial aspirations. Central to Esketit’s ethos is the principle of ‘Skin in the game’ – the founders themselves are significantly invested in the platform, reflecting a deep commitment to reliability and trust. Transparency is a cornerstone value for Esketit, with a clear disclosure of all relevant numbers to ensure investor safety and informed decision-making. With a decade of industry experience, the founders’ expertise in the lending sector is a key value proposition of Esketit. The platform also prides itself on offering sophisticated features like Auto-Invest for strategic portfolio diversification and a Secondary Market, facilitating more agile investment exits. These values and offerings are testament to Esketit’s dedication to fostering a trustworthy, efficient, and accessible financial environment for its users.

Trustfulness of the platform

Key investors of the company

| AvaFin Holding | |

| Asset under management | NA |

| Date of creation | 2012 |

| Founder | Davis Barons, Matiss Ansviesulis |

| Website | https://avafin.com/ |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Esketit is currently under, the Ireland regulator, even though they do not yet have any license. However, Eseketit recognize its significance to investors. Therefore, Eseketit are exploring the possibility of obtaining a license, possibly in Ireland or another jurisdiction.

Fees and charges

Investing through Esketit is completely free of charge. Esketit does not charge any fees for opening an account, depositing or withdrawing funds. However, Investor need to pay commission upon transferring stablecoins to Esketit platform which are normal fees for transaction processing on ethereum blockchain.

Liquidity and exit options

There are two markets: primary market and the secondary market. In general, the primary market, investors typically have to wait until the maturity period to conclude their transactions. In contrast, the secondary market provides investors with valuable flexibility, enabling them to sell their loans at their preferred time, granting them increased control over their investments.

Users feedback

| Trustpilot | |

| Average rate | 4,3/5 |

| Good review | Absolutely brilliant customer service. I had an issue with my bank account. Esketit looked into it and resolved it in no time. I was very impressed with the speed of communication and the high level of professionalism. On the investment side of things, everything works as it should. Money is getting invested. It’s well diversified as long as you do your own strategy and the returns are good. Personally, I am great fan of the secondary market as it allows to cash in very quickly. Overall, I am very satisfied and can only recommend Esketit. |

| Bad review | Created account, tried to transfer money from one of my banks account with no luck, then with another bank account made the transfer and after almost two months the money is not in my Esketit account.Open support case and there is a ping pong in the answers. Confusing web page, missing tutorials and explanations. Hard to find details about platform. User interface ia amateour, confusing and not clear even for beginners. |

Risk Analysis

As an investment platform, it is imperative for investors to acquaint themselves with specific critical risks and have a clear understanding of the platform’s risk management procedures to guarantee the security of their funds.

Credit risk

Borrower default risk

Esketit functions as a broker, facilitating connections between investors and loan originators, which are typically companies affiliated with the platform’s founders or parent company. Despite this alignment, there is a notable absence of detailed information on Esketit’s website about the specific criteria and processes employed for selecting these loan originators. This lack of transparency regarding the assessment and selection of loan originators represents a key area where Esketit could enhance its disclosure practices. Understanding the relationship and selection criteria of loan originators is crucial for investors to fully comprehend the risk profile and the integrity of their investments on the platform.

Platform risk

Operational risk

Esketit places a high priority on the security of its technology platform, implementing robust measures to safeguard data. The platform employs advanced encryption technologies and has implemented two-factor authentication to enhance user account security. A key component of their security protocol includes a comprehensive Know Your Customer (KYC) process, essential for verifying user identities and preventing fraudulent activities, including money laundering.

Data protection is taken seriously, with Esketit storing all data on secure servers located within the European Union (EU). This data management is rigorously aligned with the General Data Protection Regulation (GDPR), ensuring compliance with stringent data privacy standards. Furthermore, Esketit reserves the option to collaborate with various service providers, potentially including IT, payment processing, and legal advisory services. This collaboration is part of Esketit’s commitment to maintaining a secure, efficient, and compliant operational framework.

Regulatory risk

Esketit, operating as a peer-to-peer (P2P) lending platform, falls under the purview of the regulatory authorities in Ireland. Currently, the platform’s business model does not require a specific license. However, Esketit is actively exploring the prospect of obtaining a license, potentially in Ireland or another suitable jurisdiction. This proactive approach indicates Esketit’s commitment to regulatory compliance and its anticipation of future regulatory landscapes.

As of now, Esketit has not provided public information regarding its plans to comply with the European Crowdfunding Service Provider (ECSP) regulation, set to become mandatory for European crowdfunding companies in November 2023. This absence of disclosure suggests an area where Esketit could further align its operations with upcoming regulatory changes, enhancing its position in the European crowdfunding market.

Platform failure

Esketit functions as an intermediary, bridging the gap between investors and loan originators. The platform is responsible for holding investor funds and orchestrating their transfer directly to the chosen loan originators. As part of each investment process, investors are provided with an electronically concluded Assignment Agreement, which is readily available in their investor profile. This Agreement acts as formal confirmation of their investment in a specific loan.

In the event of insolvency, Esketit has established protocols to safeguard investor interests. The platform will initiate procedures to transfer the servicing of all concluded Assignment Agreements and investments to a qualified administrator. This measure is designed to ensure continued management and protection of investments, reflecting Esketit’s commitment to maintaining investor confidence and security even in challenging scenarios.

Liquidity risk

Esketit addresses liquidity concerns by offering a Secondary Market feature, which provides investors with enhanced flexibility. This platform allows investors to sell their existing loans to other participants within the Esketit community. Notably, the process of selling loans on this Secondary Market is designed to be user-friendly and is free of any charges. This feature is particularly beneficial for investors seeking liquidity, as it enables them to offload their investments without incurring additional costs. Esketit’s commitment to offering practical and cost-effective solutions is evident in this approach, catering to the diverse liquidity needs of its investor base.

Fraud risk

Borrower fraud

Esketit, operating as a broker, implements several measures to mitigate the risk of borrower fraud. A key safeguard is the adherence of loan originators to the regulations of their local jurisdictions, along with the possession of licenses that validate their lending activities. This regulatory compliance significantly reduces the potential for fraudulent activities.

The founders of Esketit, who also own the loan originators, demonstrate their confidence in the platform by investing their own funds. This alignment of interests is further strengthened as loan originators retain a 5% stake in each loan on their books, ensuring vested interest in the loan’s performance.

To enhance investor protection, Esketit offers a dual-layer of security: a BuyBack guarantee and a Group Guarantee. These guarantees serve as a safety net in the event of borrower defaults, providing investors with additional reassurance.

Transparency is a cornerstone of Esketit’s approach. The platform regularly publishes a management presentation for the Creamfinance Group on a quarterly basis. Additionally, the annual Creamfinance report, audited in accordance with IFRS standards, is released annually. For other Esketit loan originators based in Jordan and Sri Lanka, Esketit discloses their management financials and key operational KPIs quarterly, with annual statutory accounts being made available at the conclusion of the financial year. This comprehensive approach to reporting underscores Esketit’s commitment to transparency and investor confidence.

Platform fraud

The management of platform fraud risk at Esketit warrants consideration, particularly given that the platform is in custody of investor funds. This arrangement inherently presents the possibility that platform managers could access and potentially withdraw these funds without investor consent. While such scenarios are unlikely, they underscore the importance of rigorous internal controls and vigilance in managing and safeguarding investor assets.

Currently, Esketit does not provide public information regarding any past instances of platform fraud. The absence of such disclosures highlights an area where Esketit could enhance its communication with investors, potentially improving transparency and trust. Maintaining robust security measures and transparent reporting practices are crucial for mitigating fraud risks and reinforcing investor confidence in the platform’s integrity.

ESG risk

Esketit’s approach to Environmental, Social, and Governance (ESG) criteria is currently characterized by a limited disclosure of information. The platform has not extensively detailed its ESG policies or practices, indicating an area for potential development. Given the increasing importance of ESG considerations in investment decisions, a more comprehensive disclosure of Esketit’s ESG strategies and criteria could significantly enhance the platform’s appeal to a broader range of investors. Transparent communication about ESG commitments and practices is essential in today’s investment landscape, reflecting a platform’s dedication to sustainable and responsible financial practices.