Goldfinch – Deep Dive

Overview

Goldfinch, a decentralized credit protocol established in 2021 by Blake West and Mike Sall in San Francisco, USA, is revolutionizing crypto borrowing. Distinguished by its unique approach of offering loans without crypto collateral, these are instead fully collateralized off-chain. The platform has significantly expanded financial access globally, operating in over 28 countries with notable borrowers like PayJoy in Mexico, QuickCheck in Nigeria, and Divibank and Addem Capital in Latin America. Since its inception, Goldfinch has disbursed over $100 million in loans, with repayments exceeding $30 million, marking a new era in decentralized finance.

Key advantage of the platform

Goldfinch stands out as a decentralized credit protocol that uniquely facilitates crypto borrowing without requiring crypto collateral. This innovative approach allows companies to access crypto lending in real-world scenarios. Through the Goldfinch Protocol, businesses can draw stablecoins, such as USDC, from a liquidity pool and convert them into fiat currencies for use in their respective markets. This mechanism effectively bridges the gap between cryptocurrency and traditional finance, significantly enhancing the scope and applicability of crypto lending in various economic sectors.

Track records

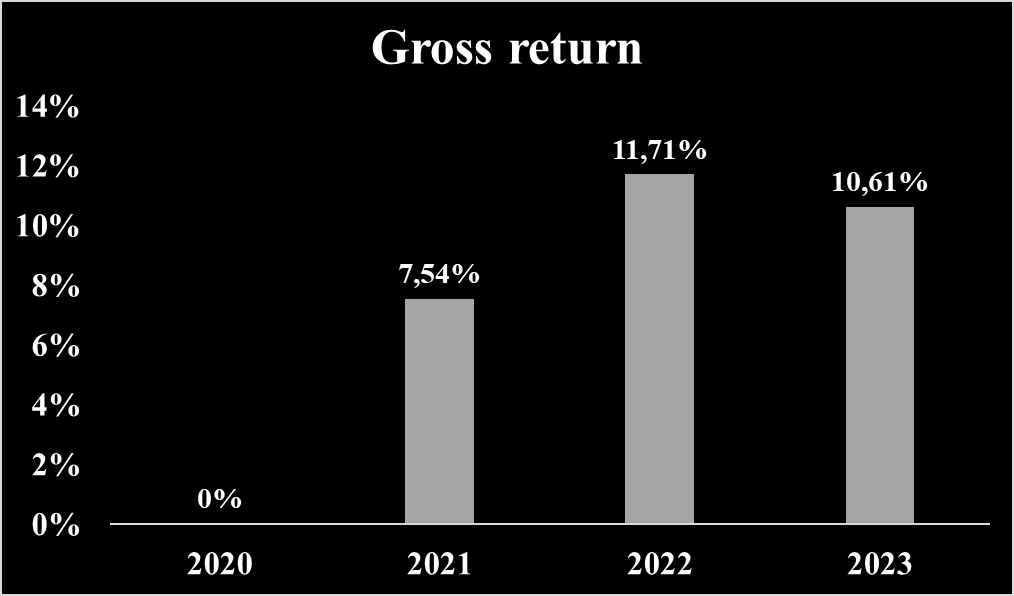

Historical returns

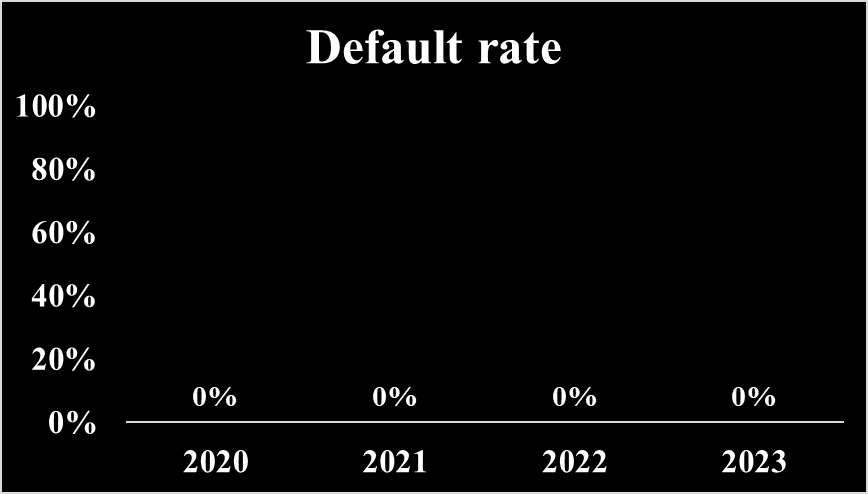

Default rate

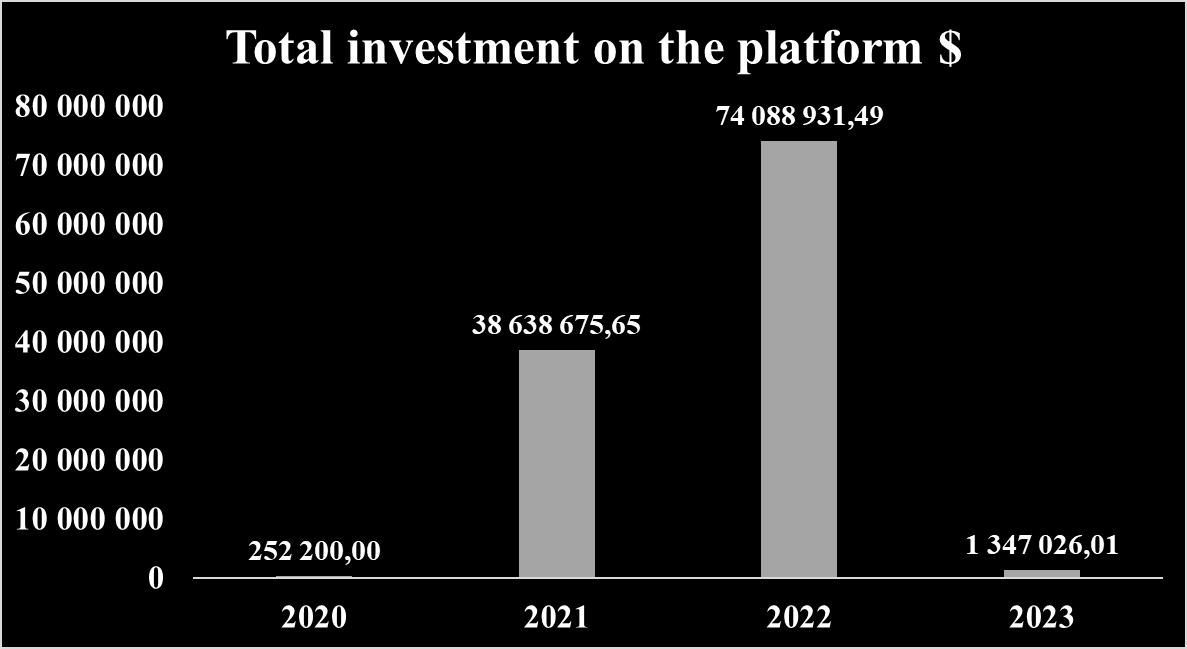

Total investment on the platform

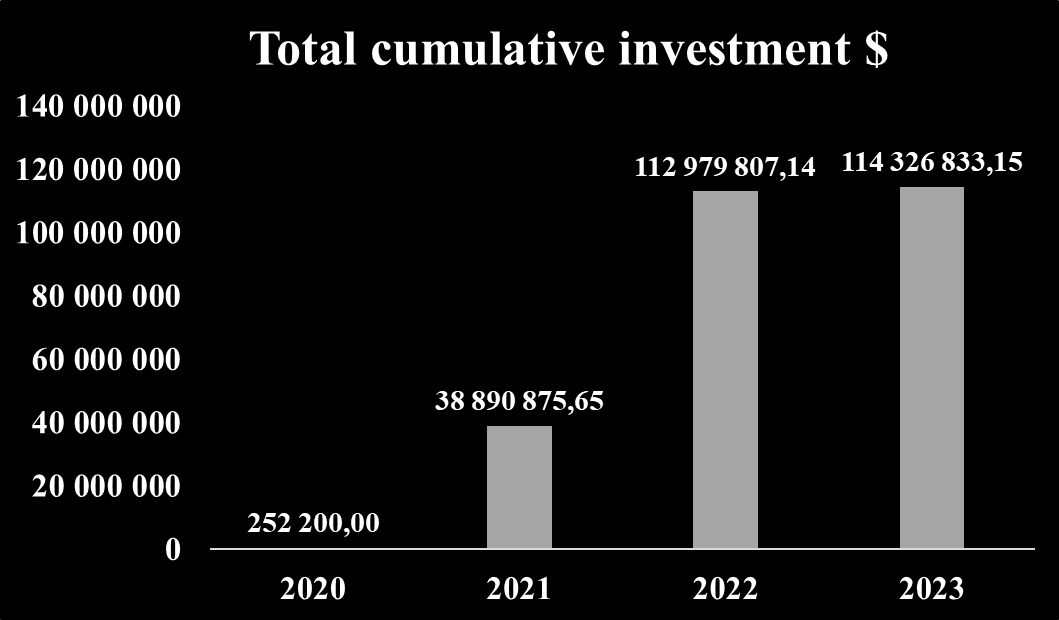

Total cumulative investment on the platform

Investment opportunities

Goldfinch is a decentralized credit protocol in the crypto space, providing loan originator, financial institution with the opportunity to participate in crypto lending.

There is no minimum investment amount for investors in Goldfinch’s project.

| Loan originator | Fazz Financial Group | Cauris Fund | Addem Capital |

| Principal | 1,347,026.01 $ | 2,126,664.22 $ | 10,000,000.00 $ |

| Interest | 392,587.91 $ | 574,985.91 $ | 3,000,000.00 $ |

| Total | 1,739,613.92 $ | 2,701,650.14 $ | 13,000,000.00 $ |

| Repayment status | On time | On Time | Grace period |

| Fixed USDC APY | 13,05% | 12,15% | 17,00% |

| Loan term | 24 months | 24 months | 37 months |

| Liquidity | Quarterly | End of loan term | End of loan term |

| Payment frequency | Monthly | Monthly | Monthly |

| Term start date | May 1, 2023 | Dec 17, 2022 | Apr 26, 2022 |

| Loan maturity date | May 1, 2025 | Dec 17, 2024 | Apr 25, 2025 |

| Repayment structure | Callable | Bullet | Bullet |

All loan in the protocol are fully collateralized with off-chain assets.

Investing process as a retail investor

- Setting Up for Investment: Investors begin by using a hot wallet, like Metamask, to interact with the Goldfinch protocol. After connecting their wallet, they are required to provide personal information and create a Unique Identity (UID), a non-transferable NFT for KYC purposes.

- Exploring Investment Options: On the Goldfinch platform, investors can explore diverse investment opportunities, including participating as a Liquidity Provider in the Senior Pool or as a Backer in the Borrower Pool for junior debt, after evaluating borrower information.

- Making an Investment: Decisions are made based on detailed project information, with investments conducted in stablecoin USD.

- Understanding Tokens and Rewards: Goldfinch utilizes two native tokens, GFI and FIDU, following the ERC20 standard. Liquidity Providers receive FIDU, while GFI is used for community governance, allowing token holders to influence protocol decisions. Early Backers in Borrower Pools are incentivized with GFI rewards.

- Tracking Investments: Post-investment, the Goldfinch dashboard enables investors to monitor their investments and stay updated on project progress.

Team and management

Goldfinch is led by a team with a wealth of experience and a proven track record of accomplishments. However, the Goldfinch team does not have a strong professional background in the finance area.

Blake West,Co-Founder of Goldfinch

Blake West, co-founder of Goldfinch, is an engineer and entrepreneur with a diverse background. He co-founded and serves as the CTO of Warbler Labs, which supports Goldfinch, a decentralized lending protocol on Ethereum. His experience includes senior roles at Coinbase, Hint Health, and involvement in music technology innovations. Academically, West graduated from Wharton School, University of Pennsylvania, with a BS in Marketing and Entrepreneurship, and a minor in Music. He also studied Computer Software Engineering at Hack Reactor. West’s journey combines technological expertise with a creative passion for music, contributing to his innovative approach in the fintech sector.

Mike Sall, Co-Founder of Goldfinch

Mike Sall, co-founder of both Goldfinch and Warbler Labs, has an extensive background in data analytics and product management. His career includes significant roles such as Head of Product Analytics at Coinbase, Co-Founder of Unbox Research, and Head of Data Science at Medium. He has also held positions at Adobe as a Product Manager and at Typekit as a Growth Analyst. Earlier in his career, Sall worked as a Business Analyst at Deloitte Consulting LLP, and he has experience in academia as a Teaching Assistant at Wharton Business School and a Research Assistant at The Wharton School. He holds a BS and BA in Economics and Art History from the University of Pennsylvania.

Mission and Values

Goldfinch, a decentralized credit protocol, is committed to transforming global credit activity by bringing it on-chain, thereby enhancing financial accessibility and inclusion. Focused on financial inclusion, Goldfinch facilitates access to capital for underserved communities by leveraging collateralized loans with off-chain assets. The platform embodies the ethos of decentralization, ensuring resilience and resistance to fraud while maintaining transparency and accountability. As a trailblazer in the DeFi space, Goldfinch uniquely integrates real-world assets into its model, creating significant value for both investors and borrowers.

Trustfulness of the platform

Key investors of the company

| a16z | Coinbase Ventures | |

| Asset under management | 35B $ | NA |

| Date of creation | 2009 | 2012 |

| Founder | Marc Andreessen and Ben Horowitz | Brian Armstrong |

| Website | https://a16z.com/fintech/ | https://www.coinbase.com/fr/ventures |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Goldfinch is a decentralized finance (DeFi) protocol that is not subject to any specific licensing or regulatory requirements.

Fees and charges

FIDU tokens represent deposits made by Liquidity Providers (LPs) into the Senior Pool and there is entry fee for the investment. Investors can exchange their FIDU tokens for USDC at 0,5% withdrawal fee. When the user ask withdrawal cancellation before it is fully funded, the user is charged a cancellation fee of 1% of the total requested amount.

Liquidity and exit options

The Goldfinch platform lacks a secondary market to sell position between investors. However, there is no obligation to keep FIDU token untill maturity because investor can sell them at any time. Investors who hold FIDU tokens can liquidate them to obtain USDC at any time.

Users feedback

There is no user feedback on Trustpilot

Risk Analysis

Investors engaging with Goldfinch should be attentive to specific and significant risks. It’s essential for them to comprehend the platform’s risk management strategies in order to safeguard their funds effectively.

Credit risk

Borrower default risk

Goldfinch’s borrower default risk management involves a detailed due diligence process with backers assessing borrower creditworthiness. Borrowers form a decentralized organization (DAO) with various parties, including backers, who guarantee the loan and analyze borrower data stored in a virtual data room. This data includes historical performance, transaction structure, security overview, and specific documentation like term sheets and loan agreements. The backers’ investment in borrower pools reflects their confidence in the loan, with backers assuming the first loss in defaults.

Currently, the protocol’s Auditor system is inactive, but there are plans for its future implementation, subject to community voting. Auditors will validate borrower legitimacy, further strengthening the protocol against fraud. They will be randomly selected based on their staked GFI to assess borrowers’ claims and check for collusion.

Platform risk

Operational risk

Goldfinch prioritizes security by engaging external auditors for a thorough review of all smart contract code. The platform’s security measures include audits from well-regarded blockchain protocol companies such as Certik and Trail of Bits. To further enhance security, Goldfinch operates a $500,000 bug bounty program through Immunefi, encouraging individuals to identify and report any vulnerabilities in its software, website, or digital systems. Goldfinch stores customer data securely on the Ethereum blockchain and keeps stakeholders informed through various channels, including Medium, their website, press releases, and the DAO forum.

Regulatory risk

Goldfinch operates within the decentralized finance (DeFi) sphere, independent of traditional financial systems and without conventional licensing regulatory frameworks. Its governance is managed by a DAO community, empowering members to perform maintenance functions and modify protocol parameters via decentralized voting. This structure reflects a common risk in cryptocurrency protocols, where the regulatory landscape remains uncertain. Investors in DeFi platforms, including Goldfinch, should be aware of these inherent regulatory risks as part of their investment decision-making process.

Platform failure

Goldfinch ensures its resilience and long-term functionality through a DAO community, which holds the authority to propose and implement changes to the protocol’s smart contract code. This open-source code allows for community-driven modifications with DAO approval. The platform’s financial health is transparently displayed on blockchain analytics platforms, though expert interpretation is advised. While Goldfinch does not offer direct insurance, investors can opt for Nexus Mutual coverage against smart contract risks. The protocol incorporates backup systems and leverages DAO governance for business continuity, including emergency protocol pausing and configuration adjustments, ensuring uninterrupted operation.

Liquidity risk

Goldfinch, lacking a secondary market for trading positions, compensates with the flexibility offered by the FIDU token. Investors in Goldfinch’s Senior Pool are rewarded with FIDU tokens, which can be sold at any time. FIDU tokens are exchangeable for USDC, providing a liquidity option. Withdrawal requests for these conversions are processed bi-weekly, ensuring liquidity for investors despite the absence of a traditional secondary market.

Fraud risk

Borrower fraud

Goldfinch’s approach to borrower fraud risk involves a comprehensive assessment by backers to evaluate borrower creditworthiness. Borrowers propose pools to the community, outlining deal terms and structures. Backers, either individuals or companies, guarantee loans and perform due diligence using data stored in virtual data rooms, covering aspects like historical performance and security overviews. Investors then decide on investing USDC in borrower pools, reflecting their confidence. The protocol’s UID system verifies borrower identities, crucial for legal compliance and fraud prevention. Transparency in fraud detection is maintained through discussions on the DAO forum. A recent incident involved a defaulted loan by Tugende, a Kenyan taxi financing company, leading to significant measures by Goldfinch for recovery and restructuring.

Platform fraud

Goldfinch mitigates platform fraud risk through its unique DAO community treasury, used for payments to backers. The platform does not hold investor funds directly; instead, investors deposit funds through smart contracts that operate autonomously. Upon investment maturity, these funds are autonomously returned to investors. This process, governed by smart contracts, ensures the safeguarding of investor funds, relying on the precise and secure programming of these contracts to manage all financial operations.

ESG risk

Currently, detailed information regarding Environmental, Social, and Governance (ESG) criteria on the Goldfinch platform is limited. This paucity of information suggests an area where Goldfinch could enhance its transparency and engagement with ESG practices, aligning with evolving investor expectations and global sustainability trends.