Income – Deep Dive

Overview

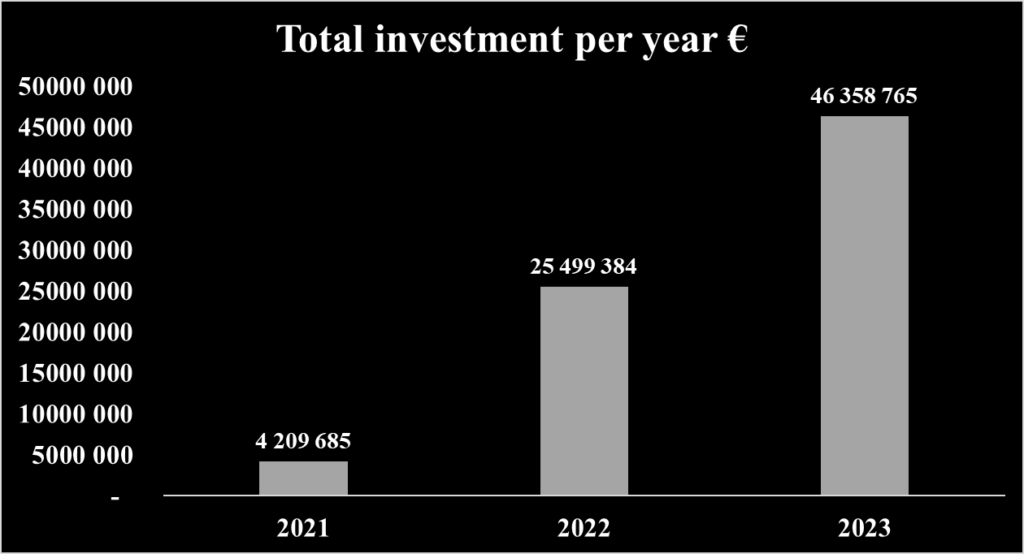

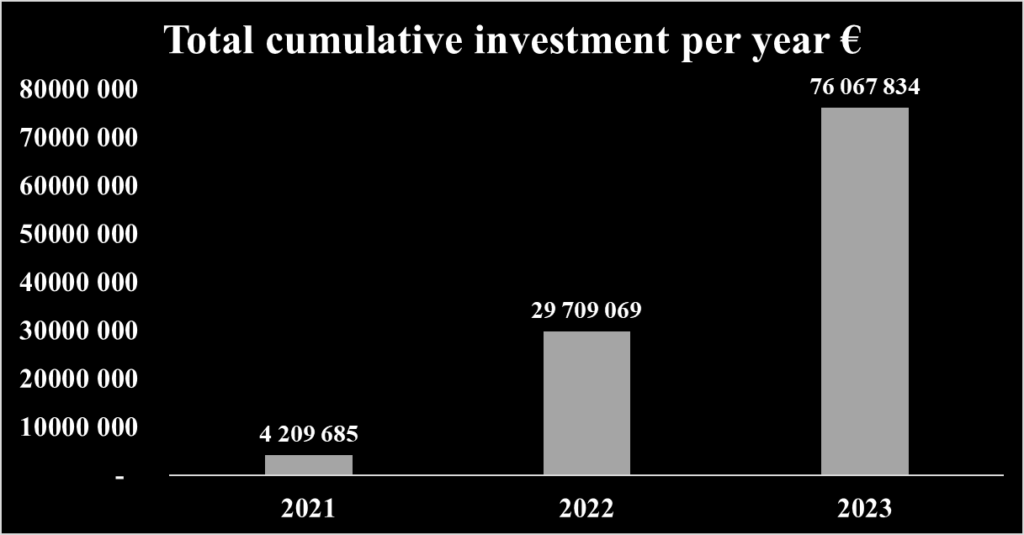

Income, a trailblazing peer-to-peer (P2P) lending marketplace, acts as a dynamic bridge connecting investors with borrowers in a secure and streamlined environment. Founded in 2021 by visionary entrepreneur Kimmo Rytkönen, Income emerged with the innovative idea of facilitating effortless and safe investment opportunities in cashflow assets. These assets range from consumer loans to real-estate portfolios, encompassing a diverse array of options with predictable cash flows. Strategically headquartered in the vibrant city of Tallinn, Estonia, Income’s primary mission is to revolutionize financing and investment solutions. The platform serves as a comprehensive marketplace catering to both individuals and businesses on a global scale. In the short span since its inception in 2021, Income has rapidly gained traction in the investment community. Investors have entrusted the platform with over 76 million euros, drawn by an impressive average interest rate of 13.78%. This remarkable growth trajectory underscores Income’s commitment to offering robust investment avenues and exemplifies its success in reshaping the landscape of P2P lending.

Key advantage of the platform

At the heart of Income’s innovative investment platform lies a commitment to security and reliability. Investors have the unique opportunity to engage in asset investments that are robustly secured by the diverse portfolios of the loan originators. This strategic approach not only diversifies risk but also enhances the stability of the investments.

Setting Income apart in the marketplace are its distinctive security features: the Buyback Obligation and the Cashflow Buffer. These mechanisms are meticulously designed to safeguard investor interests. The Buyback Obligation provides a reassuring layer of protection, ensuring that investors are shielded in the event of borrower default. Meanwhile, the Cashflow Buffer acts as a financial cushion, offering additional security and peace of mind. Together, these features form a comprehensive safety net, fortifying investor confidence and paving the way for a more secure investment journey.

Track records

Historical returns

Data not available

Default rate

Data not available

Total investment on the platform per year

Total cumulative investment on the platform

Investment opportunities

Income is a P2P lending marketplace platform that allows individuals or corporates to invest in several cashflow assets.

The minimum amount to invest in the platform is: 10€.

| Loan type | Installment loan | Installment loan |

| Loan amount | 10 983 € | 9 679 € |

| Remaining principal | 10 983 € | 9 679 € |

| APR for a borrower | 36,53% | 30,54% |

| Interest rate offered to investors | 10% | 10% |

| BuyBack Obligation | Yes, 60 d. | Yes, 60 d. |

| Initial term | 2y.11m.29d | 4y.11m.30d |

| Issuance country | Estonia | Estonia |

| Available for investing | 2 405,36 € | 4 162,25 € |

| Hoovi junior share 20% | 2 196,60 € | 1 935,80 € |

| Investors share | 6 381,04 € | 3 580,55 € |

All loans offered on the platform are securitized by a BuyBack obligation from the loan originator. In cases where a loan originator cannot fulfill this guarantee, a Cashflow Buffer comes into play.

Investing process as a retail investors

- Account Creation and Verification: The journey on the Income platform begins with the creation of an investor account. Prospective investors are required to provide essential personal and financial details, including their name, surname, email, phone number, and ID card. This step also encompasses a thorough Know Your Customer (KYC) verification process, ensuring compliance with regulatory standards and maintaining the platform’s integrity.

- Exploration of Investment Opportunities: Once registered, investors can delve into the diverse range of investment options available on the Income platform. The platform offers an intuitive interface where each investment opportunity is showcased on a dedicated page. This setup allows investors to conduct quick yet comprehensive due diligence, providing all necessary information about each project’s specifics and potential.

- Investment Selection and Execution: After thorough review and consideration, investors can decide on their preferred investment. The platform offers flexibility in investment strategies, allowing investors to manually select specific loans to fund or to opt for an automated investment approach through the Auto Invest portfolio strategy. This step marks the transition from contemplation to action in the investment process.

- Currency Specification: A crucial aspect of the investment process on Income is the currency requirement. All transactions on the platform are conducted in Euros (EUR), necessitating that payments and investments be made in this currency. This specification ensures streamlined financial operations and eliminates potential currency exchange complications.

- Investment Monitoring and Updates: Post-investment, investors can conveniently monitor the progress of their investments through their Income accounts. The platform is committed to transparency and regular communication, providing frequent updates on the projects that investors have funded. This ongoing engagement ensures that investors remain informed and involved throughout the lifespan of their investments.

Team and management

The Income team consists of investment professionals and individuals with a strong background in consumer lending.

Kimmo Rytkönen, Founder of Income

Kimmo Rytkönen, founder of Income Marketplace, is a seasoned Credit Expert and Fintech Operations Executive with over 15 years of experience in the consumer lending and startup sectors. His expertise includes team building and technology implementation. Rytkönen established Income Marketplace in 2020 in Tallinn, Estonia, and serves as a Board Advisor for Vakuutustori.fi. He has previously held significant roles at PT Bank Amar Indonesia Tbk. and Supernova JV S.à r.l. Academically, he holds a BA in Management & PR from the University of Lincoln and a BBA from Mercuria Business School. This combination of professional and academic experiences positions Rytkönen as a notable figure in the fintech industry.

Lavrenti Tsudakov, CEO of Income

Lavrenti Tsudakov is a versatile IT professional with extensive experience in project management and team leadership across various sectors, including energy, logistics, and banking. He has rapidly ascended at Income Marketplace, serving as CEO since October 2023 after roles as Chief Operating Officer and Operational Manager. Tsudakov also has experience as Chief Operational Officer at BONSAY.AI and LifeUP OÜ. His previous positions include Head of Business Intelligence at Avalanche Laboratory and IT Product Manager at Eesti Post. Academically, he holds an MBA in IT Management from Tallinn University and a Bachelor of Science in Information Technology from the University of Tartu.

Maciej Wenerski, Head of Loan Originators Due Diligence of Income

Maciej Wenerski is the Head of Loan Originator Due Diligence at Income Marketplace since October 2020. His prior roles include Senior Financial Controller at Cosmose Inc. and Financial Controller at Aasa Global, both in Warsaw, Poland. Wenerski also brings valuable experience from EY, where he served in various consultancy roles. Academically, he holds a Master’s in Finance and Accounting from SGH Warsaw School of Economics and a Bachelor’s in Management from the University of Warsaw. He has also passed Level I of the CFA Program, underscoring his expertise in finance.

Mission and Values

Income’s mission is dedicated to empowering individuals and businesses by providing a robust peer-to-peer lending platform that facilitates reliable income generation and fosters inclusive growth. At the core of Income’s philosophy are the values of integrity, transparency, and trust, which are pivotal in ensuring a fair and accessible lending environment for all. The company is steadfast in its commitment to financial inclusion and responsible practices, reflecting a deep dedication to the well-being and success of every stakeholder involved. Embracing continuous innovation, Income stays at the forefront of the financial sector, adeptly adapting to the ever-evolving financial needs and challenges of today’s dynamic world.

Trustfulness of the platform

Key investors of the company

Data not available

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Income platform are not regulated in Estonia where the platform has it’s headquarter therefore, the platform currently doesn’t hold any licence to operate.

Fees and charges

Investing on the Income Marketplace is free for investors. Income generates revenue by charging fees on the loan originators.

Liquidity and exit options

There is currently no existing secondary market that allows investors to sell their investments to another Income investor before the investment’s maturity date. However, Income is working on implementing a secondary market function to enhance the liquidity of investments.

Users feedback

| Trustpilot | |

| Average rate | 3,8/5 |

| Good review | the application works great! I am very happy to have now focussed my P2P activities mostly to income ! I like Income experience so far: useful auto-invest tool , great returns for loans investments, prompt and friendly support team |

| Bad review | They didn’t give me the bonus for joining via referral link. On contacting support, support member says she can’t get IT team to check it. It’s now more than 2 weeks from when I first contacted support, and 2 months from when I opened the account and still no bonus. |

Risk Analysis

Credit risk

Borrower default risk

Income platform acts as a broker between loan originator and investors. Unfortunately, there are not any explanation on the website of the company on the process used to select loan originator available on the platform. The user have to rely directly on the internal process of the platform which is not documented.

Platform risk

Operational risk

Income rigorously manages operational risk, particularly in the realm of data protection and investor identity verification, in adherence to high industry standards. The platform ensures that all investor data is securely transferred and stored within the European Economic Area (EEA), thereby aligning with the stringent requirements of the General Data Protection Regulation (GDPR). To fortify the integrity of account creation, Income incorporates the services of Veriff for identity verification. Veriff is a globally recognized, comprehensive identity verification solution that complies with multiple regulatory frameworks including the California Consumer Privacy Act (CCPA), SOC2 Type II, and the Web Content Accessibility Guidelines (WCAG). This multi-faceted approach underlines Income’s unwavering commitment to safeguarding investor privacy and data, reflecting their dedication to maintaining a secure and trustworthy investment environment.

Regulatory risk

The platform currently doesn’t hold any certificate to operate it’s activities. This is not an issue because, there are not any regulation on this type of activity on it’s head quarter country: Estonia. However, since 2023, a new regulation has been established in Europe for crowdfunding/crowdlending platforms called: ECSP. The platform will have to comply to this regulation in order to allow all European investors to continue to invest on its loans. There are not any information on any project started by the company to comply with this new regulation.

Platform failure

Income operates as a crucial intermediary in the financial ecosystem, facilitating connections between investors and borrowers. The platform’s role is not to originate loans directly; instead, it provides an avenue for investors to channel their funds into loans sourced from various borrowers. In addressing the risk of platform failure, Income has instituted robust measures to assure business continuity. In the event of insolvency, the platform is prepared with a structured response: an appointed insolvency administrator will assume responsibility for managing and settling all outstanding investments. Moreover, Income has established a proactive partnership with a Certified Auditor Office, ensuring the secure storage and availability of backup data when necessary. This strategic approach underlines Income’s commitment to operational resilience and the safeguarding of stakeholder interests even in challenging scenarios.

Liquidity risk

Income doesn’t have a secondary market. However, Income is working on implementing a secondary market function to increase the liquidity of investments for investors.

Fraud risk

Borrower fraud

Income operates as a broker between investors and loan originators, skillfully navigating the complexities of borrower fraud risk. The platform implements a Buyback Guarantee for all listed loans, providing a robust safeguard against borrower default. This guarantee serves as a pivotal element in protecting investor interests. Additionally, Income has innovatively introduced a Cashflow Buffer mechanism. In the event of a Loan Originator default, this buffer enables Income to strategically allocate funds from the loan portfolio, prioritizing the repayment of investors’ principal and interest, thereby enhancing investor security.

The platform stipulates that a rigorous audit of loan originator is performed notably, a rigorous KYC process has been established to check loan originator background and identify. However, there are not any information available on the process used by the platform which create a lack of transparency and coud generate a high risk for an investor. In addition, there are not any public disclosure of any frauds that have occurred on the platform

Platform fraud

In its approach to managing platform fraud risk, Income employs a meticulous financial segregation strategy. Investors’ funds are securely held in a separate bank account, distinctly isolated from the accounts used for the platform’s daily activities. This separation is a critical safeguard designed to protect investors’ assets from unauthorized access or misuse.

While this system provides a fundamental layer of security, it is crucial to recognize the inherent risks associated with fund management. Given that the Income platform has control over these funds, the possibility of unauthorized access or misappropriation by managers, though unlikely, remains a risk factor. To enhance investor confidence, transparency in fund handling and stringent access controls are paramount.

ESG risk

Income, a contemporary investment platform, has yet to comprehensively outline its approach towards Environmental, Social, and Governance (ESG) criteria. The platform, at present, offers limited information on how it integrates ESG considerations into its investment strategies or operational practices. This lack of detailed ESG criteria disclosure suggests an area for potential development, as increasingly more investors and stakeholders prioritize sustainable and responsible investment practices. The integration of ESG factors is becoming a pivotal aspect of investment decision-making, reflecting a global shift towards more ethically and environmentally conscious business operations. As the investment landscape evolves, platforms like Income may benefit from adopting clear, transparent ESG guidelines to align with this progressive trajectory, thereby enhancing their appeal to a broader, more conscientious investor base.