Mintos – Deep Dive

Overview

Mintos, established in 2015 in Latvia by entrepreneurs Martins Sulte and Martins Valters, has rapidly emerged as a premier peer-to-peer lending platform in Europe. Renowned for its innovative P2P marketplace model, Mintos offers investors access to a diverse array of loans from global lenders. The platform’s highly scalable business model has been a key factor in its ascension as Europe’s largest loan investment platform. By 2023, Mintos boasted over 530,000 users and an impressive €9.4 billion invested since its inception. Operating across more than 62 countries, it provides investment opportunities spanning Europe, Latin America, and Southeast Asia. However, regulatory compliance issues prevent citizens and residents of the United Kingdom and the United States from registering or investing on Mintos, highlighting its commitment to adhering to international financial regulations.

Key advantage of the platform

Mintos stands out as Europe’s foremost crowdlending platform, boasting an impressive investment volume exceeding €9 billion from its user base. Distinct from traditional investment models, Mintos empowers retail investors to extend loans to financial companies globally. This unique approach ensures a diversified investment portfolio across various loans, rather than limiting investors to direct lending to individual borrowers. A pivotal aspect of Mintos’s success is its secondary market, which offers users the flexibility to resell their investments at their discretion. This feature not only enhances liquidity but also contributes significantly to the platform’s appeal among investors.

Track records

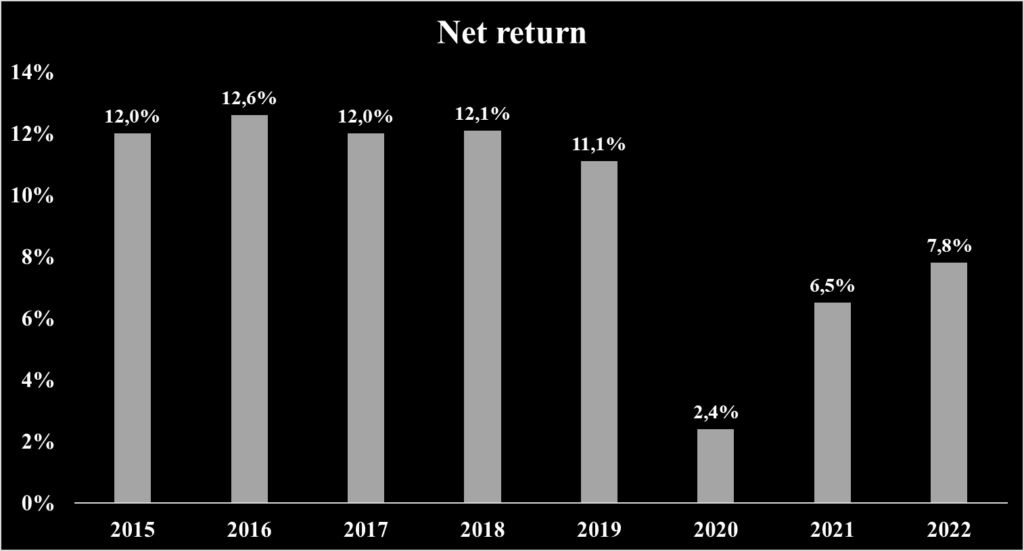

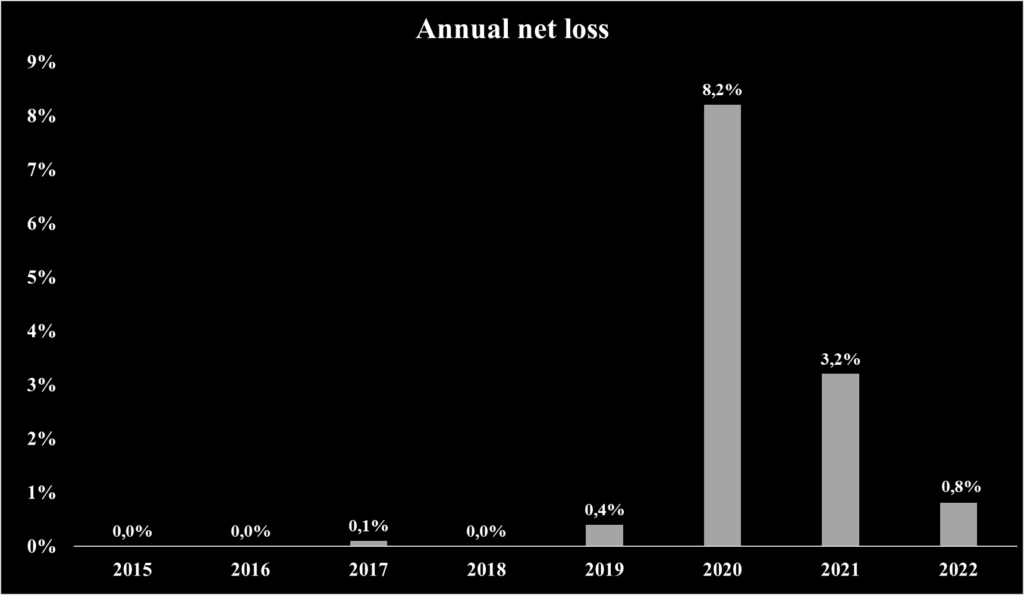

Historical returns

Net return

Default rate

Total investment on the platform per year

Data is not available

Total cumulative investment on the platform

Data is not available

Investment opportunities

Description of investment product

Mintos is the largest European loan investment platform with more than 530 000 users recorded in 2023 and an average return rate around 12,6% and 9,4 billion € invested since 2015.

The minimum amount to invest into Minto’s project for retail investors is 50 €

| Note: LVX0000BE0J7 | Note: LVX0000BAR29 | Note: LVX0000AQ360 | |

| Country | Kazakhstan KZ | Kenya KE | Moldova MD |

| Underlying loan type | Personnal Loan | Short term Loan | Personnal Loan |

| Mintos Risk Score | 6 | 3,2 | 7,4 |

| Principal amount | 2440699,2 ₸ | 818,20 € | 3 591,05 € |

| Remaining principal | 2440699,2 ₸ | 799,32 € | 3 206,63 € |

| Registration date | 17/10/2023 | 11/10/2023 | 15/09/2023 |

| Expected due date | 13/08/2027 | 09/11/2023 | 30/03/2024 |

| Original due date | 13/08/2027 | 09/11/2023 | 30/03/2024 |

| Interest rate | 21% | 12% | 10% |

| Guarantee | Buy back obligation | Buy back obligation | Buy back obligation |

| Interest on late payments | 21% | 12% | 10% |

The platform provides a buyback option for certain notes, designed to mitigate potential losses in the event of a borrower’s default.

Investing process as a retail investors

- Account Creation: The investment journey on Mintos begins with account creation, where investors provide essential personal and financial information, including their name, surname, email, and phone number, ensuring a secure and personalized investing experience.

- Exploring Investment Opportunities: Investors can explore a variety of investment opportunities on Mintos. The platform provides comprehensive information on each project, enabling investors to conduct thorough due diligence. Each investment opportunity features a detailed page with insights about the company, the specific investment, Mintos risk score, and associated risks.

- Selecting and Making an Investment: After reviewing the details, investors can proceed with their investment decision. Mintos offers diverse investment options, including Mintos Core for automated diversified portfolio investments, Mintos Custom for personalized automated strategies, and manual investing for selecting individual loans.

- Investment Tracking: Investors can monitor the progress of their investments through their Mintos accounts. The platform ensures regular updates on the invested projects, allowing investors to stay informed about their investments’ performance.

- Utilizing the Secondary Market: Mintos provides an innovative Secondary Market, where investors can list their Notes for sale to other Mintos users. This feature enhances liquidity, offering the option to sell investments for quicker access to funds, with the flexibility to set premiums for higher returns or discounts for faster sales.

Team and management

Mintos is led by a team of experts with a wealth of experience and a proven track record of accomplishments.

Martins Sulte, the CEO and Co-Founder of Mintos

Martins Sulte has significantly contributed to the crowdlending sector since May 2014. Prior to Mintos, he was a Member of the Supervisory Board at the Alternative Financial Services Association of Latvia for nearly five years. Sulte’s experience includes a six-year tenure as an Associate at SEB Investment Banking, and earlier roles as a Consultant at Ernst & Young, and internships at NASDAQ OMX and UniCredit. Academically, he holds an MBA from INSEAD (2013) and a B.Sc. in Business and Economics from the Stockholm School of Economics in Riga (2003-2006).

Martins Valters is the Co-Founder and COO of Mintos

Martins Valters has held since April 2017. Prior to his current role, he served as the CFO of Mintos from January 2015 to September 2022. Valters brings extensive experience from his time at Ernst & Young as a Senior Manager, where he developed expertise in the financial sector, including auditing large banks and groups in Latvia and Switzerland. He also had an internship at Swedbank. Academically, he completed his education at the Stockholm School of Economics in Riga from 2001 to 2004.

Karlis Kronbergs is the Chief Risk Officer (CRO) of Mintos

Karlis Kronbergs, with over 15 years of experience in credit, corporate finance, and risk management, currently serves as the Chief Risk Officer (CRO) at Mintos since June 2020. Previously, he was the Head of Corporate and Mid Corporate Customers in the Baltics at Citadele banka, and also managed credit risk for the group. Kronbergs played a significant role at Kredītinformācijas Birojs, supervising the establishment of Latvia’s first credit bureau. His earlier roles include Head of Credit Analysis and Credit Risk at Parex Bank, along with being a Board Member at Parex Lizing. He holds a BSc in Economics and Business from the Stockholm School of Economics in Riga (2000-2003).

Mission and Values

Mintos is driven by a mission to elevate loans as a mainstream asset class and to establish itself as the preeminent peer-to-peer marketplace globally. The company is steadfast in its belief that true reputation stems from concrete actions rather than mere words. A cornerstone of Mintos’ approach is its commitment to collaboration, fostering robust partnerships with loan originators, investors, and various stakeholders. This collaborative spirit is integral to its success. Furthermore, Mintos is devoted to relentless innovation, constantly refining its services and developing cutting-edge solutions to cater to the evolving needs of its customers.

Trustfulness of the platform

Key investors of the company

| Mintos (Key Investors) | Description |

| Maris Keiss | Maris Keiss is a co-founder of 4finance and Mogo. 4finance is a multinational online consumer lending group that offers a variety of short-term and medium-term loans to individuals and businesses. Mogo is a financial technology (FinTech) company that provides financial services to consumers. |

| Aigars Kesenfelds | Aigars Kesenfelds is also one of the investor of Mintos and he holds a Bachelor of Science Economics and Business from Rīgas Ekonomikas augstskola – Stockholm School of Economics in Riga. He is co-founder of 4finance and Mogo, angel investor in Artsy and Madara Cosmetics. |

| Kristaps Ozols | Kristaps Ozols is co-founder of 4finance and Mogo |

| Alberts Pole | Alberts Pole is co-founder of 4finance and Mogo |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

AS Mintos Marketplace (registration no. 40103903643) is an investment firm licensed and supervised by Latvijas Banka, the central bank of Latvia. License number 06.06.08.719/534. Mintos is a member of the national investor compensation scheme established under EU Directive 97/9/EC.

Fees and charges

Mintos does not charge fees for investing, deposing money, withdrawing money, account serving and investor support. However, fees and charges occured in severals situations such as:

- Currency exchange: From 0,50% depending on currency pair

- Secondary Market: 0,85 % for selling investments

- Inactivity: 2,90 € per month

- Recovery charges: Depends on the individual case but can’t exceed the recovered amount. The platform will inform investors about such charges before withholding them.

Liquidity and exit options

There is existing of two markets such as the primary market and the secondary market. In general, the primary market, investors are required to wait until the maturity period to close their deals. However, the secondary market offers investors the valuable flexibility to sell their loans at any moment they choose, providing them with greater control over their investments.

Users feedback

| Trustpilot | |

| Average rate | 3,8/5 |

| Good review | Examining this app over an extended period, trust was not initially established; however, it has proven to be a reliable long-term method to safeguard one’s finances from depreciation. The app’s user-friendliness allows for manual individual investments, but if that isn’t preferable, automation is an option. Company communication displays transparency, and with no previous scandals, trust remains intact unless future incidents occur. A problem arose due to a Wise account error, resulting in funds being incorrectly directed to Mintos. Notably, the Mintos customer support agent, Viesturs, demonstrated a collaborative, patient, and understanding approach throughout the complex issue resolution, leaving each interaction highly satisfactory. Ultimately, the problem was successfully resolved. What stands out about Mintos is their dedication to transparent communication, delivering not only positive news but, importantly, addressing the less favorable updates when things deviate from expectations. As an investor, this commitment to transparency is of utmost importance. |

| Bad review | My money was taken by Mintos after they asked for detailed information about how I financed a house purchase from years before I joined as a customer. Despite having several companies and a long history of stock trading, I couldn’t provide all the requested details, leading to my suspension and loss of funds. There are suspicions that Mintos has ties to the Russian mafia. The information about pending payment interest should be available easily, so customers can keep track and make sure they are not harmed. Unfortunately, as this is not available, I have to ask Mintos every month for that. With their poor customer support, they are taking a lot to provide this information, which makes me question its reliability. |

Risk Analysis

As an investment platform, investors need to be aware of certain key risks and understand how the platform manages them to ensure the safety of their funds.

Credit risk

Borrower default risk

Mintos employs a comprehensive due diligence process for managing borrower default risk, leveraging the Mintos Risk Score, a robust credit scoring system graded on a scale from 10.0 (low risk) to 1.0 (high risk). This score encompasses four key subscores:

- Loan Portfolio Performance Subscore (40%): Focuses on loan portfolio quality, evaluating non-performing loan ratios, annual percentage rates, and maturity terms against operational costs, and assessing trends in non-performing loans and track record seniority.

- Loan Servicer Efficiency Subscore (25%): Assesses the loan servicer’s efficiency in payment collection, considering governance, management experience, risk controls, and loan administration processes.

- Buyback Strength Subscore (25%): Evaluates the obligor’s ability to meet contractual obligations, liquidity needs, and capital sufficiency, factoring in financial profile, management experience, and diversification in revenues and geographies.

- Cooperation Structure Subscore (10%): Examines the legal framework of the lender-Mintos relationship, focusing on Mintos’ access to borrower-related cash flows, recoverability potential, and transparency for investors.

Platform risk

Operational risk

Mintos rigorously prioritizes operational risk management, particularly emphasizing technology platform security. The platform implements robust two-factor authentication, which users can activate in their account settings. This feature, often involving mobile phone verification via the Google Authenticator app or similar alternatives, adds a critical layer of account protection.

Regarding data security, Mintos ensures all user data is transferred and stored securely within the European Economic Area (EEA). The platform maintains stringent encryption standards for data stored on its servers, safeguarding user privacy. Access to personal information is restricted within Mintos, limited only to employees with a legitimate business requirement.

Additionally, Mintos is proactive in updating its Risk Score, typically on a quarterly basis. This process allows for timely adjustments in response to significant changes in the risk profile of specific Notes on the platform.

Regulatory risk

Mintos operates within a stringent regulatory environment under the supervision of Latvijas Banka, Latvia’s central banking authority, responsible for overseeing investment services in the country. The platform’s adherence to regulatory standards is further demonstrated by its participation in the national investor compensation scheme, aligned with EU Directive 97/9/EC. To ensure continual compliance with these regulatory requirements, Mintos undergoes third-party audits conducted by SIA KPMG Baltics, a measure that underscores its commitment to regulatory conformance and operational transparency.

Platform failure

Mintos, adhering to EU Directive 97/9/EC, is integrated into an investor compensation system that offers up to 90% compensation for losses, capped at 20,000 €. The platform’s commitment to financial integrity is further exemplified through regular third-party audits by SIA KPMG Baltics. Mintos has implemented comprehensive business continuity measures, including insolvency procedures overseen by Latvijas Banka. Additionally, the platform ensures investor fund safety through its compensation scheme. Emphasizing transparency, Mintos provides access to audited documents and regularly updated credit scoring information, with the financial accuracy validated by EY and KPMG. This approach reinforces investor confidence, with Mintos securely holding investor funds in exchange for notes issued via the platform.

Liquidity risk

Mintos effectively manages liquidity risk by offering a Secondary Market feature. This platform enhancement allows investors to sell their Notes to other Mintos users with the option of setting a premium or discount. This mechanism significantly bolsters liquidity by facilitating easier asset reallocation among investors. Transactions on the Secondary Market incur a nominal fee of 0.85%, ensuring a streamlined and efficient trading experience. Such a feature demonstrates Mintos’ commitment to providing flexible and liquid investment options.

Fraud risk

Borrower fraud

Mintos adopts a proactive approach to mitigate borrower fraud risk, utilizing advanced resources like Spark and Accuity databases, alongside collaborations with fraud-prevention agencies. This strategy enables the platform to effectively identify and prevent fraudulent activities. To foster investor transparency and informed decision-making, Mintos provides detailed information pages on each loan originator. Additionally, Mintos routinely conducts in-depth research on these originators, assigning them scores based on multifaceted criteria. These measures offer investors valuable insights, aiding them in evaluating the credibility and trustworthiness of borrowers.

Platform fraud

Mintos upholds platform transparency and integrity through rigorous third-party audits by SIA KPMG Baltics, which validate its operational and security measures. As a participant in the EU Directive 97/9/EC national investor compensation system, Mintos provides investors with a safety net, offering compensation up to 90% of net losses, capped at €20,000. Additionally, the platform features a buyback option on selected notes to mitigate losses in case of borrower default. While these measures significantly reduce platform fraud risk, the possibility of unauthorized fund access by managers, albeit low, remains a consideration in the risk profile.

ESG risk

Mintos has established its inaugural Environmental and Sustainability Policy, underscoring its dedication to global environmental stewardship. The policy not only educates employees on ecological matters but also advocates for remote work to diminish transportation-related emissions. Emphasizing principles of conservation, sustainability, and resource reuse, Mintos, as an online marketplace, takes its environmental footprint seriously. The company adheres to energy reduction guidelines as per local, European, and international standards, demonstrating its commitment to minimizing environmental impact in the digital finance sector.