October – Deep Dive

Overview

October, a French company founded in 2014 by Olivier Goy, revolutionizes the lending landscape by enabling both individual and institutional investors to finance SMEs across Europe. Initially known as “Lendix,” the company’s headquarters are in Paris, with additional offices in Spain, Italy, the Netherlands, and Germany to cater to the diverse needs of borrowers and lenders. October stands out with its innovative use of a proprietary machine learning scoring algorithm and the expertise of seasoned analysts, offering attractive opportunities for investors seeking exposure to the private credit market in Europe.

Key advantage of the platform

A key advantage of the October platform is the partial funding of all loans available to retail investors by October’s investment fund, which comprises institutional investors and the company’s management team. This strategy ensures a harmonious alignment of interests between the platform and its retail investors, fostering a sense of shared investment goals and mutual trust.

Track records

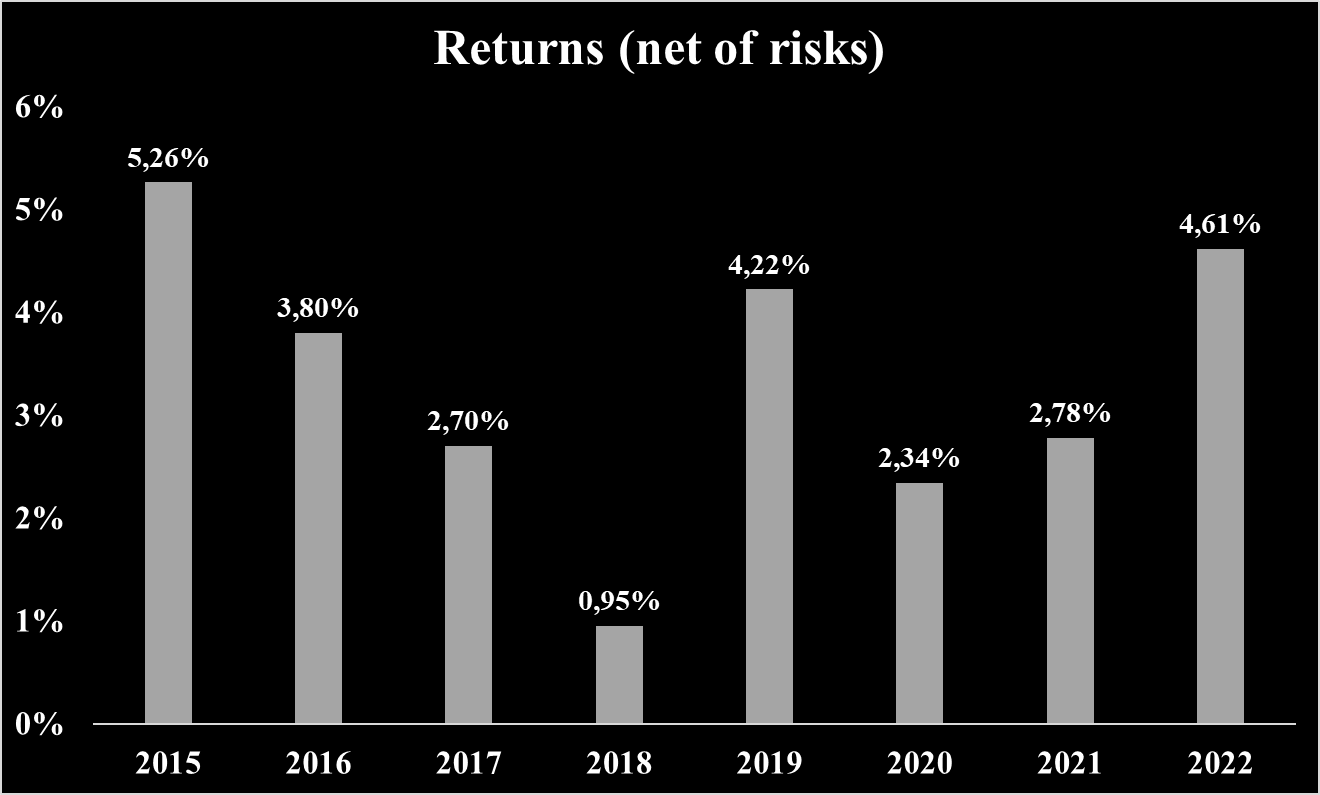

Historical returns

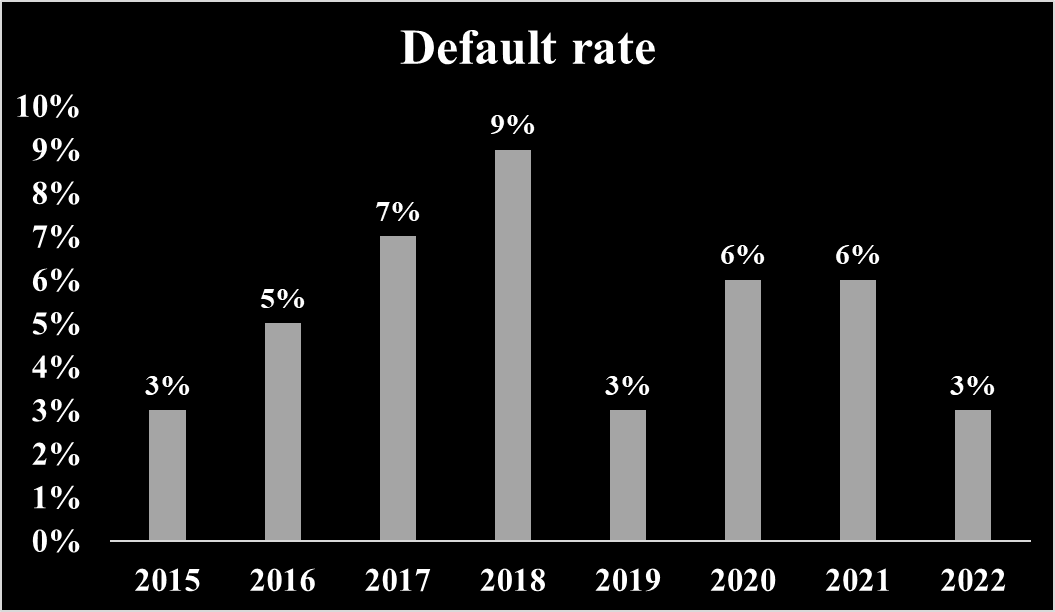

Default rate

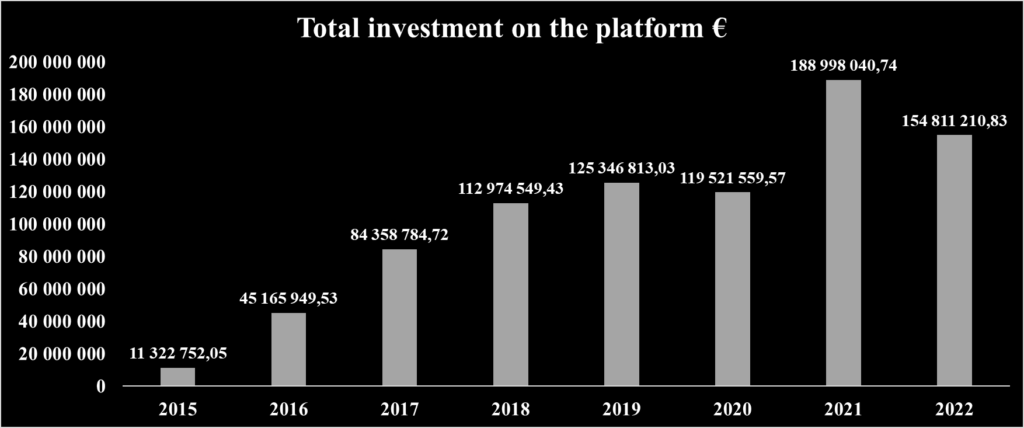

Total investment on the platform

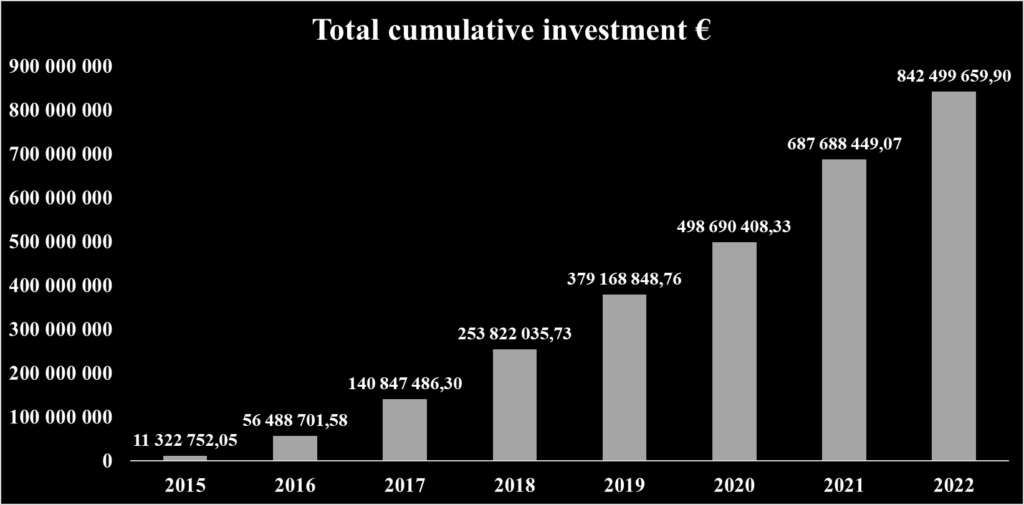

Total cumulative investment on the platform

Investment opportunities

Since it’s inception, the company has allowed it’s investors to lend more than 1 billion € to a vast range of European SMEs operating in various fields. Investments opportunities offered by the platform are investment in private credit of European SMEs.

The platform is opened to both individual and institutional investors. Minimum investment amount for individual investors is: 20 €.

Below examples of investments available:

| Bistronomie Parisienne | Morisson Clothing SI | Zeeuwse Chalets | |

|---|---|---|---|

| Loan description | A french company operating in catering sector looking to expand it’s activities | A spanish company owning a store selling leather goods and shoes looking to expand it’s activities | A netherlandish company that sells chats looking to improve it’s stock |

| Company Turnover | 650 000 € | 4 000 000 € | 5 000 000 € |

| Country | France | Spain | Netherland |

| Maturity (months) | 60 | 24 | 60 |

| Amount | 200 000 € | 157 600 € | 155 000 € |

| Rate | 8,8 % | 10 % | 9,9 % |

| Date | 30 septembre 2023 | 20 septembre 2023 | 28 september 2023 |

Most of loans available on the platform are unsecured except “Lease” that are backed by assets purchased by October. However, some companies are backed by a regional guarantee on a part of the loan.

Investing process as a retail investor

- Funding the Account: Investors initially fund their accounts via credit card or bank transfer. Funds are held by Lemon Way, the payment service provider, ensuring that the platform does not hold client money directly, which mitigates financial loss risk in case of platform failure.

- Loan Selection: Investors select loans matching their risk profile.

October provides essential information and ratings for each loan, aiding informed investment decisions. - Investment Allocation: Investors decide the amount to invest in each loan. Diversification across various loans is advised to limit exposure to specific sectors or countries.

- Loan Agreement: A loan agreement between the investor and the borrower is established, authorizing October to manage the loan.

- Receiving Payments: Investors receive periodic reimbursements or interest as per the loan’s repayment schedule.

- Handling Defaults: October manages any delays or defaults, without imposing additional fees on investors.

Team and management

An overview of October’s management team suggest a strong understanding of financial services and risk management.

Olivier Goy, Cofounder & chairman of October.

Olivier Goy is a European FinTech company focused on financing businesses. Prior to October, Goy founded and chaired 123 Investment Managers, a private equity management company. He also contributes as a board member at France Fintech and co-founder & board member at Fondation photo4food. Goy’s experience includes being an ambassador at the Paris Brain Institute and roles at Partech and Institut du Cerveau. Academically, he studied at EM Strasbourg Business School. His career reflects a deep engagement in financial services, fintech innovation, and philanthropy.

Patrick de Nonneville Cofounder & CEO.

Patrick de Nonneville, has a rich background in finance and leadership. Before October, he held the position of Partner at Goldman Sachs, co-heading European Interest Rates Products. His experience also includes serving as Managing Director at Deutsche Bank and Vice President at JP Morgan. In addition to his corporate roles, he was a board member at Kantox, a London-based fintech company. Academically, de Nonneville is an alumnus of École Polytechnique, holding a degree in engineering, and studied mathematics at Condorcet. His career spans significant roles in global financial institutions, underscoring his extensive expertise in the sector.

Mission and Values

October is firmly dedicated to transforming the landscape of business financing. With a clear mission to elevate financing for SMEs across Europe, October utilizes cutting-edge data analytics and technology. This approach has led to the development of a sophisticated risk platform, which facilitates quick and precise credit assessments for European SMEs, marking a significant advancement in the realm of business finance.

Trustfulness of the platform

Key investors of the company

The company has 22 investors including:

| Partech | Hackquarters | |

| Asset under management | 2.5bn € | NA |

| Date of creation | 1982 | 2015 |

| Founder | Karim Tadjeddine | Kaan Akin |

| Website | http://partechpartners.com | http://www.hackquarters.co |

Institutional lenders

In addition to retail investors, the platform allows famous institutional investors to invest on the loans provided such as:

- European investment fund

- BPI France

- La caisse des dépôts et consignation

- El instituto de credito official

- Intesa San Paolo Group

- La casa depositi e Prestiti

- CNP Assurances

- Invest NL

Licenses

Registered as an intermediary in participatory financing (IFP) under number 15000364 on the registry of ORIAS.

Registered as agent of Lemon Way payment service provider under registration number 69593 on the registry of REGAFI.

An ECSP license is an authorization granted by the national competent authority of an EU member state to acrowdfunding service provider to operate within the EU. October obtained an ECSP license.

Fees and charges

The platform does not charge any fees nor charges to investors. However, the platform withdraw directly from interest earned the taxable amount depending on the user country (only for some European countries).

Liquidity and exit options

All loans invested through the platform are held by investors until their maturity. Investors could not sell their investments.

Users feedback

| Trustpilot | |

| Average rate | 2.9/5 |

| Good reviews | People appreciate the simplicity of fluidity of the platform that allows to diversify savings |

| Bad reviews | People complaint against defaults on loans and lack assistance by the company to recover loss. |

Risk Analysis

As an investing platform, investors should be aware to some key risks and how they are managed/mitigated by the platform to ensure their money are in good hands.

Credit risk

Borrower default risk

October manages borrower default risk using a robust rating methodology that combines proprietary machine learning with manual analysis. This approach was significantly refined following a high default rate experienced between 2017 and 2018. To mitigate this risk, investors are advised to diversify across a wide range of loans. The platform’s credit assessment technology, “October Connect,” is endorsed by institutional investors like CNP Assurances and utilized by banks for borrower creditworthiness checks, underscoring its reliability. However, October’s small team for loan repayment issues outsources claims management to external agencies, which could potentially lead to challenges in this area.

Platform risk

Operational risk

One of the primary operational risks associated with platforms like October is cyber risk. While specific details on cyber risk management are not extensively detailed on October’s website, the risk associated with financial losses is somewhat mitigated by the platform’s practice of not holding investor funds directly. However, like any website, the risk of a data breach remains a relevant concern, emphasizing the need for robust cybersecurity measures.

Regulatory risk

October operates under the IFP “Intermédiaire en financement participatif” license, granted by ORIAS in France, essential for conducting P2P lending in the country. Adapting to evolving regulations, October has aligned with the new “ECSP” European regulation on crowdfunding, set to be implemented across the EU by November 2023. As of September 2023, October has successfully met all the criteria of this new regulation, securing an ECSP license and reaffirming its commitment to regulatory compliance.

Platform failure

October acts solely as an intermediary between lenders and borrowers, with direct loan agreements managed by the platform. In the event of platform failure, these agreements remain intact, ensuring lenders can continue to receive reimbursements. Additionally, as October does not hold investor funds, any platform failure would still allow investors to access their funds through their Lemon Way portfolios. This operational model offers a safeguard for both lenders and investors, maintaining the continuity of financial transactions and access to funds even in unforeseen circumstances.

Liquidity risk

On October’s platform, loans are intended to be held until maturity, as there is no secondary market for investors to sell their positions. This absence of liquidity is an important consideration for investors using the platform. The primary means for investors to recoup their invested amount prior to maturity is through the early repayment of the loan by the borrower, which incurs an early exit fee to compensate the investor. This structure emphasizes the need for investors to be cognizant of the liquidity constraints when committing their funds on the platform.

Fraud risk

Borrower fraud

October employs a blend of technology and human expertise for loan analysis. “Instant Project” loans are predominantly evaluated using the platform’s proprietary scoring algorithm, with analysts focusing primarily on fraud detection and document authenticity. The platform maintains discretion in communicating past fraud incidents to protect borrower privacy. A blog article highlighted that during 2018-2019, there were seven defaults due to fraud, involving false borrower declarations, internal fraud, and falsified financial statements. Since then, October appears to have significantly enhanced its approach to managing borrower fraud risk.

Platform fraud

As Europe’s pioneering platform for lending to SMEs, October has garnered significant trust, evidenced by its use by local governments for providing loans to SMEs. This utilization by public entities underscores the platform’s reliability and integrity, positioning it as a trusted and secure option in the SME lending space.

ESG risk

October employs a proprietary algorithm to evaluate borrowers’ ESG scores, influencing loan rates and borrower eligibility. However, the platform currently does not provide specific information on the ESG policies of its borrowers. This lack of detailed ESG data is a notable limitation, especially as investor interest in ESG practices grows. Investors are, therefore, encouraged to conduct their own ESG assessments of borrowers using available information, such as company websites. Enhancing ESG transparency on the platform could align with evolving investor priorities and strengthen the platform’s competitive edge in sustainable finance.