Percent – Deep Dive

Overview

Percent, an innovative alternative investment platform, was established in June 2018 in New York, USA, under the initial name Cadence, before rebranding to Percent in 2021. Founded by Nelson Chu, the platform’s mission is to streamline private credit investing and deliver high-yield returns to accredited investors. Based in New York, Percent presents a diverse array of investment opportunities across three primary sub-asset classes: asset-based securities, corporate loans, and limited partner investments in funds. This variety caters to a wide range of investor preferences, solidifying Percent’s position in the alternative investment market.

Key advantage of the platform

Percent, catering primarily to institutional investors in the USA, offers a vast array of private credit opportunities. Key benefits include its diverse investment options, ranging from straightforward business loans to innovative future cash flow-backed loans. The platform functions effectively as a broker, connecting private credit investment funds with investors. Currently exclusive to accredited investors in the USA, Percent has plans to broaden its reach to a wider investor base in the future.

Track records

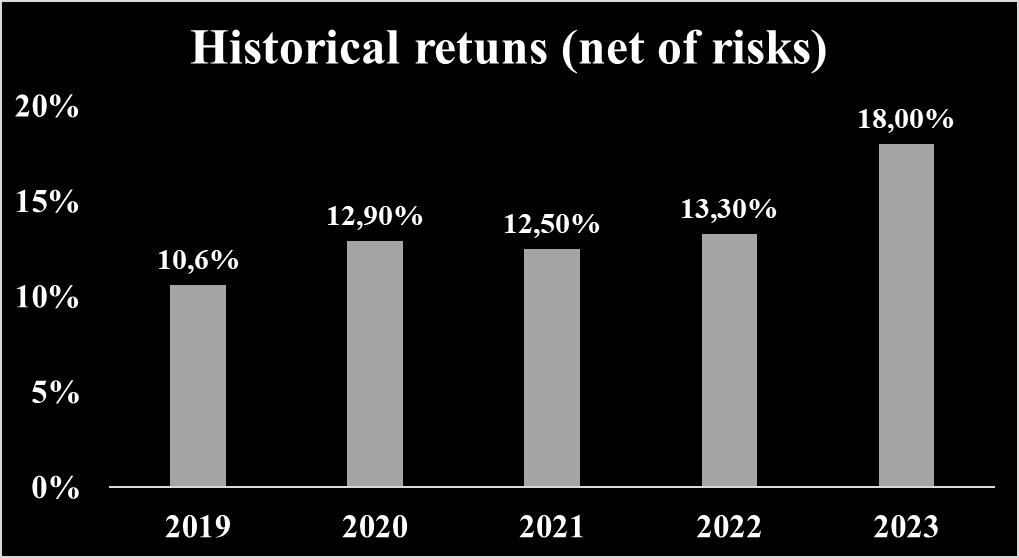

Historical returns

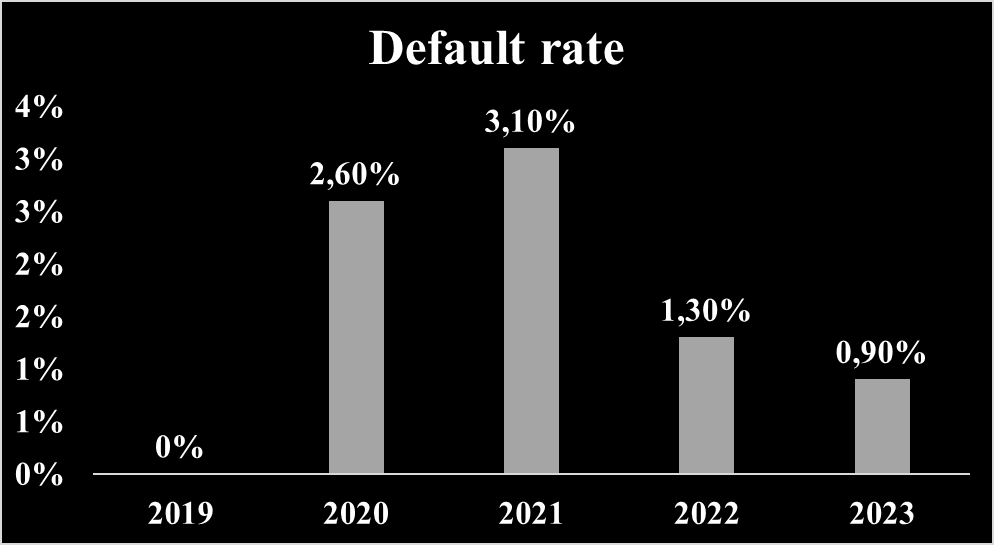

Default rate

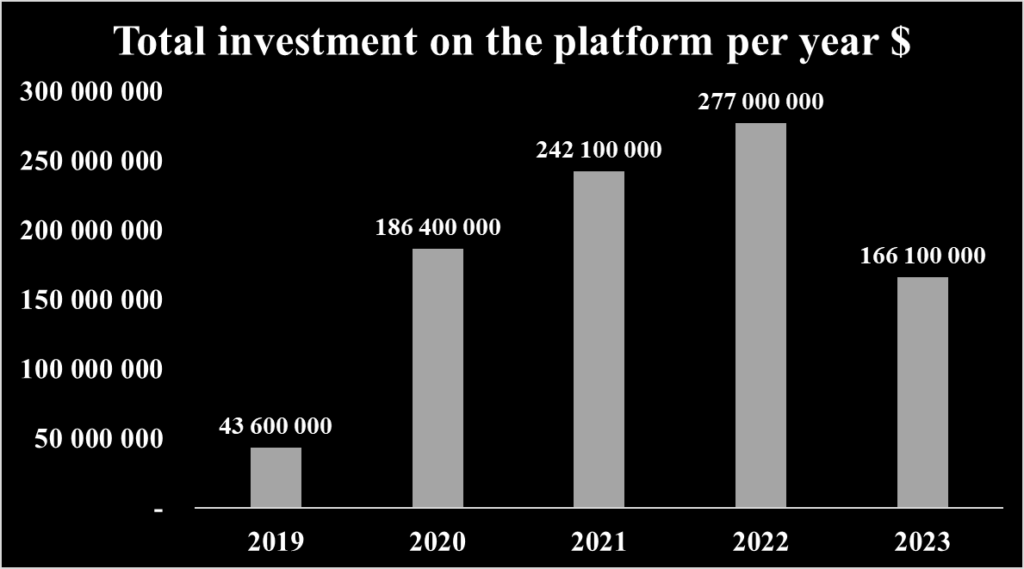

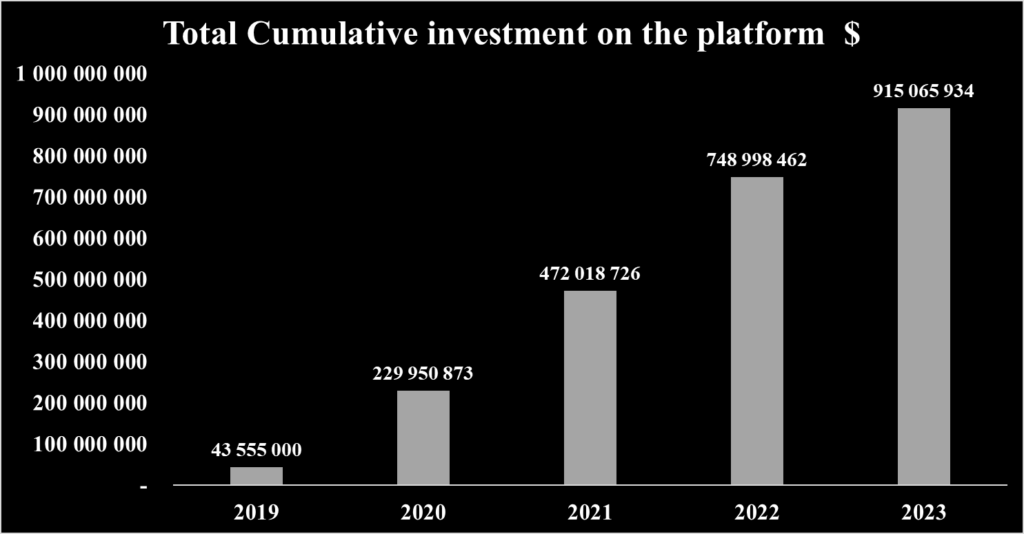

Total investment on the platform

Total cumulative investment on the platform

Investment opportunities

Percent allowed investors to invest more than 882 millions dollar and has 463 funded deals. Percent hold 774 millions dollar of loans and has returned 34 millions dollar as interest to investors since its inception.

The minimum amount to invest into Percent’s project for investor is 500 $ (5000$ for loans of type « Blended Note »).

| HAP Corporate Loan Sr. 2023-1 | PAH US Asset-Based Jr. 2023-1 | FRT Inventory Financing Sr.2023-2 | |

| Country | USA | USA | USA |

| Maturity | 16 months February 21, 2025 | 35 months September 20, 2026 | 7 months May 19, 2024 |

| APY | 18,38 % | 15 %-19 % | 12 %-14% |

| Closing Date | October 18,2023 5 :00 PM | October 20, 2023 5:00 PM | October 19, 2023 5:00 PM |

| Funding Ends | October 17,2023 6 :00 PM | October 19,2023 6 :00 PM | October 18, 2023 6:00 PM |

| Instrument issued | Secured promissory note | The Unsecured Notes | The Unsecured Notes |

| Distribution | Floating interest rate return | NA | NA |

| Minimum investment | 10 000 $ | 10 000 $ | 500 $ |

| Investment Objective | 1000 000 $ | 1000 000 $ | 500 000 $ |

Most loans are secured on the Percent platform, it means that the loans are guaranteed and protect investors from repayment defaults.

The differents guaranted available on the platform are :

- Portfolio of underlying loans

- Receivables

- Advances

- Contract with future cash flows

Investing process as a retail investor

- Account Creation: The investment journey on Percent begins with account creation, requiring personal and financial details, including KYC verification.

- Funding the Account: Investors can fund their accounts via wire transfer, with Percent providing guidance. Fees for wire transfers are borne by the investor. Deposits over $50,000 and withdrawals over $100,000 must be via wire transfer. Percent does not hold client funds, reducing financial loss risk in case of platform failure.

- Exploring Investments: Investors can review various opportunities on Percent, with detailed project information available for due diligence. Direct contact with Percent is possible for further project details.

- Investment Decision: Each investment opportunity has a dedicated page detailing company information, investment potential, and associated risks. Investors select their investment amount and minimum acceptable rate.

- Tracking Investments: Post-investment, Percent allows investors to monitor their investments through their accounts, providing regular updates and payment schedules based on the loan structure.

Team and management

The management team at Percent demonstrates a robust comprehension of financial services.

Nelson Chu, Founder & CEO of Percent

Nelson Chu, the Founder and CEO of Percent, is a notable figure in the financial technology space. His journey began with Percent, founded in 2018, which has evolved into a leading platform in credit market transactions. Prior to this, he founded a strategic consulting firm and held significant roles in top financial institutions like Bank of America and BlackRock. As an active angel investor, Chu has contributed to various startups, including BlockFi and Clover Health. His academic credentials include a degree from Rutgers University in Economics and Political Science. His career demonstrates a blend of strategic insight and a deep understanding of financial markets.

Prath Reddy, President of Percent

Prath Reddy, holding the position of President at Percent since April 2021, has been instrumental in shaping the modern private credit market. Prior to his current role, he was the Managing Director, Head of Capital Markets at the same company. His professional background includes tenure as a Director at UBS and an Associate at Crédit Agricole CIB, where he was involved in debt capital markets, particularly in structuring and executing bond financings. Reddy’s academic foundation in finance was laid at Northeastern University, where he earned his Bachelor’s degree.

Bina Shetty, Head of Client Solutions of Percent

Bina Shetty serves as the Head of Client Solutions at Percent, bringing an extensive background in investment banking and capital markets. Her career has included strategic advisory roles and senior positions in capital raising and mergers and acquisitions. With experience at firms like Sortis Capital, Milestone Advisors, Canaccord Genuity, and CIBC World Markets, Shetty has a deep understanding of financial services. She began her finance journey at Merrill Lynch and Hovde Financial. Academically, she holds a BBA in Finance and Accounting from The George Washington University and has completed studies in Financial Modeling at the University of Pennsylvania.

Mission and Values

Percent is dedicated to redefining the landscape of alternative investments with its core principles of Transparency, Accessibility, and Liquidity. The platform is committed to demystifying alternative investments, making them readily available, and enhancing their liquidity. The goal is to equip investors with a powerful platform that fosters informed financial decisions, enabling them to shape their financial destinies. This vision laid the foundation for Percent’s evolution into an expansive technology platform, pioneering a new era in the private credit market by aligning with these guiding principles.

Trustfulness of the platform

Key investors of the company

| WHITE STAR CAPITAL | B Capital Group | |

| Asset management amount | 750 M $ | More than US$2.2 trillion |

| Date of creation | 2014 | 2015 |

| Founder | Eric Martineau-Fortin and Jean-Francois Marcoux | Eduardo Saverin and Raj Ganguly |

| Website | https://whitestarcapital.com/ | https://www.bcapgroup.com/ |

Institutional lenders

There aren’t any institutional investor using the platform to invest on private credit.

Licenses

Percent is registered as a member of FINRA

Percent holds the folowing license:

- Securities Broker-Dealer: This license allows Percent to sell and trade securities on behalf of its clients.

- Investment Adviser Representative: This license allows Percent’s employees to provide investment advice to clients.

Investor money is stored in a bank with FDIC insurance. This coverage ensures that funds deposited with Percent are protected, up to the legal limit of 250,000 $.

Fees and charges

The firm charge investor fees however, it does charge the companies, issuers or borrowers raising capital a placement agent fee that varies on each transaction. This placement agent fee is disclosed in each transaction’s respective private placement memorandum and is an indirect cost to investors as many companies, issuers and borrowers consider their all-in cost of capital when making decisions on what level of return they want to make available to investors.

Each investment opportunity on the platform will have a fee that is equivalent to 10% of each advertised interest payment (not the principal), automatically collected from each distribution.

There is special case about Blended Note Investments where a 1% management fee is taken by the platform and the minimum investment for investors is 5 000 $ .

Liquidity and exit options

Investors must retain their loans until they reach maturity and are unable to sell their investments through the platform.

Users feedback

| Trustpilot | |

| Average rate | 3,4/5 |

| Good reviews | Great customer supportThe investments are solid! I will continue to add additional money each month now that I have some experience with the platform. |

| Bad reviews | These guys certainly have to do something with their verification system. It just does not work. The very process always failed. This system just can not read your selfie by comparing it with your standard documents as driver`s license or passport. |

Risk Analysis

As an investment platform, investors need to be aware of certain key risks and understand how the platform manages them to ensure the safety of their funds.

Credit risk

Percent employs a rigorous due diligence process to manage borrower default risk by assessing counterparty risk and asset performance risk. The evaluation process delves into borrowers’ financial stability, operational capabilities, technological infrastructure, and both internal and external risks. Following counterparty assessment, the focus shifts to asset performance risk, where the risk profile of underlying assets is scrutinized, including structural and portfolio considerations. Investment opportunities from third parties undergo a distinct due diligence process, evaluating the third party’s background, underwriting policies, and expertise in private credit, ensuring a comprehensive risk assessment before any loan is approved and presented to investors.

Platform risk

Operational risk

Percent prioritizes investor protection through robust security protocols. The platform manages investments using Special Purpose Vehicles (SPVs), ensuring a secure and isolated environment for each investment. With advanced data protection practices, Percent implements top-tier KYC procedures for identity verification and employs multi-factor authentication to bolster account security. Encryption safeguards data both at rest and during transmission. In the event of operational disruptions, direct issuer contact is facilitated. Additionally, Percent commits to transparency, providing investors with comprehensive, quarterly portfolio data for informed assessment and decision-making.

Regulatory risk

Percent operates within the stringent regulatory framework of the United States, adhering to the regulations set forth by the Securities and Exchange Commission (SEC) to ensure the integrity of the securities markets and protect investor interests. As a member of the Financial Industry Regulatory Authority (FINRA), Percent is licensed as a Securities Broker-Dealer, facilitating securities trading for its clients, and holds an Investment Adviser Representative license, authorizing its employees to provide investment advice. These credentials underscore Percent’s commitment to regulatory compliance and investor protection.

Platform failure

Percent fortifies its resilience and investor protection through strategic financial structures. Special Purpose Vehicles (SPVs) are utilized to individually manage investments, enhancing security. Should operational challenges arise, a third-party administrator is appointed to oversee investment management to term. Moreover, investor funds are secured in FDIC-insured bank accounts, offering coverage up to $250,000 and are held distinct from Percent’s operating funds. This segregation is corroborated by external accounting reviews. In the event of Percent ceasing operations, a pre-designated manager assumes control, ensuring the orderly conclusion of transactions and the return of funds to investors.

Liquidity risk

Investors on Percent must note the absence of a secondary market, necessitating the holding of loans until maturity. This feature highlights the crucial consideration of liquidity when engaging with investments on the platform, as investors’ capital will be tied up for the duration of the loan period without the option for early exit through secondary sales.

Fraud risk

Borrower fraud

Percent employs stringent security measures, including advanced identity verification for KYC compliance and robust AML procedures, to mitigate the risk of borrower fraud. Despite these precautions, financial fraud can still occur, as evidenced by one of Percent’s three defaults being attributed to fraud. The platform is actively involved in ongoing litigation related to this case, demonstrating its commitment to resolving such issues and maintaining platform integrity. This proactive approach exemplifies Percent’s dedication to safeguarding its investors’ interests and upholding high ethical standards in its operations.

Platform fraud

Percent’s approach to managing platform fraud risk involves stringent financial controls. The platform’s structure ensures that managers do not have direct access to client funds. Instead, investor money is securely held in an FDIC-insured bank account, with protection covering up to the legal maximum of $250,000. This arrangement prevents unauthorized access to investors’ funds by Percent’s managers, providing an added layer of security and peace of mind for investors using the platform.

ESG risk

Currently, detailed information regarding the Environmental, Social, and Governance (ESG) criteria on the Percent platform is limited. This scarcity of public ESG data suggests a potential area for enhancement, aligning with the growing investor interest in sustainable and responsible investment practices. Expanding on ESG disclosures could further strengthen Percent’s commitment to transparency and ethical investing.