Anaxago – Deep Dive

Overview

Anaxago, established in 2012 by French entrepreneurs Caroline Lamaud, Joachim Dupont, and Francois Carbone, stands as a distinguished crowdfunding platform in France. It specializes in connecting borrowers with an array of investors, ranging from private individuals to institutional entities. The platform is renowned for facilitating access to private debt investments, particularly in high-yield real estate projects. Additionally, Anaxago broadens investment horizons by offering opportunities in private equity and Real Estate Investment Trusts (REITs), catering to a diverse investor base seeking varied investment options.

Key advantage of the platform

Anaxago distinguishes itself by its commitment to aligning the interests of its management team with those of its investors. This alignment is achieved through the team’s direct investment in each operation on the platform. This strategy not only demonstrates confidence in the projects but also fosters a shared investment journey, ensuring that the management’s goals are intricately linked with the success and satisfaction of their investors.

Track records

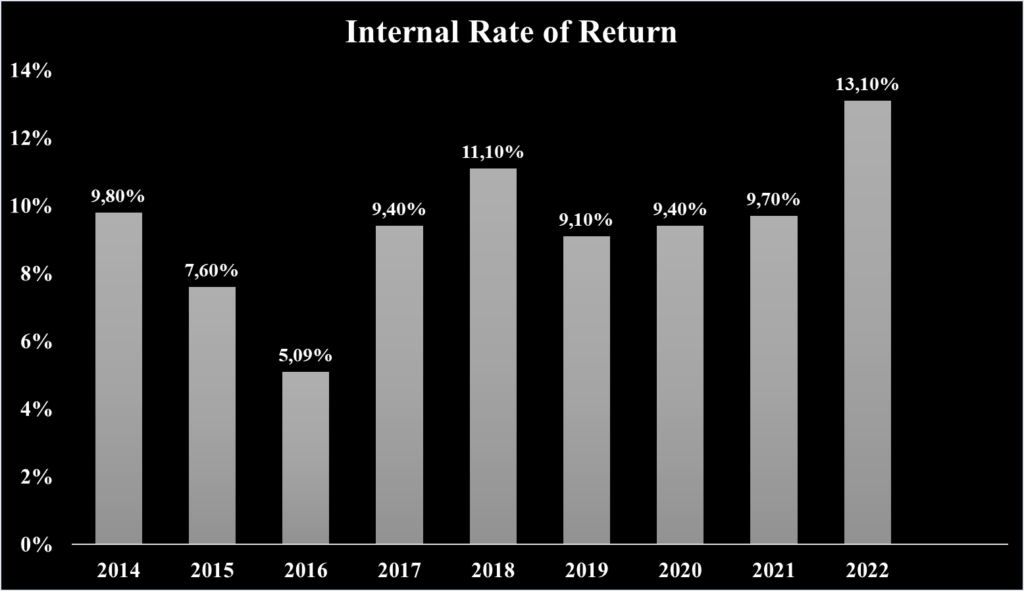

Net return

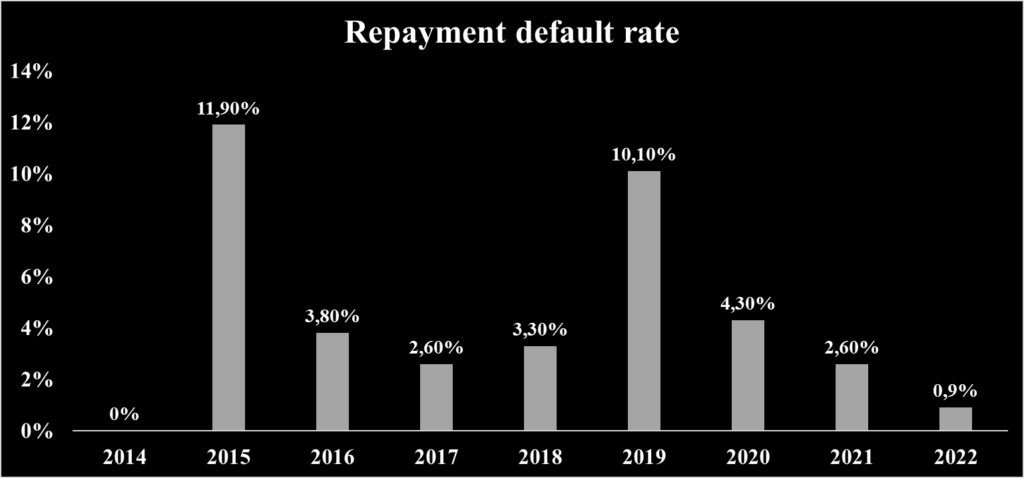

Repayment Default rate

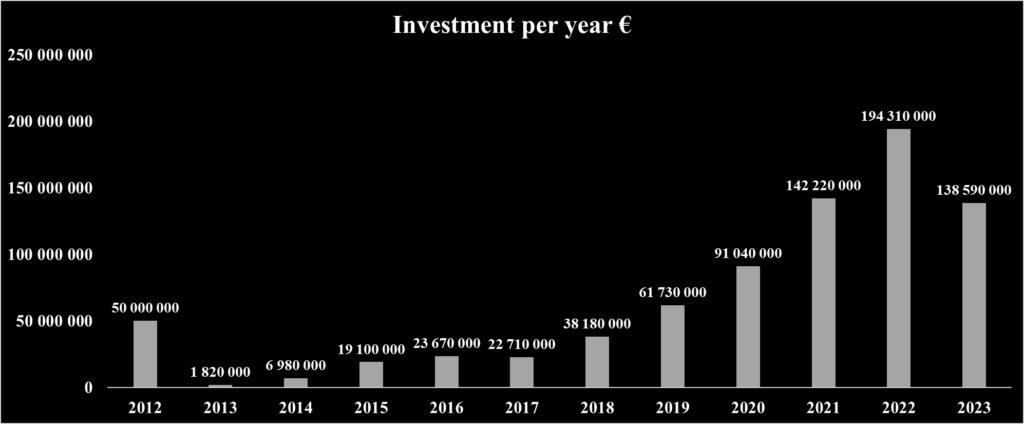

Total investment on the platform per year

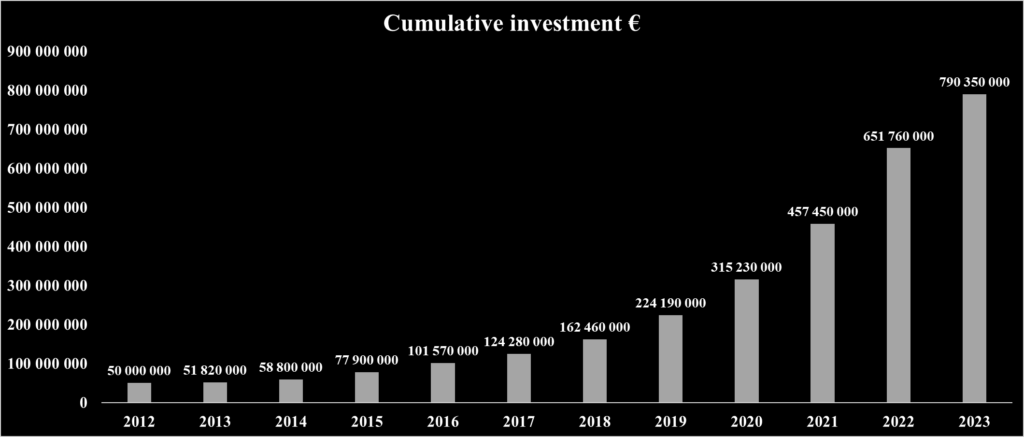

Total cumulative investment on the platform

Investment opportunities

Since 2012, Anaxago has invested more than 700 millions euros in 336 companies and more than 218 million of interests have been distributed to investors. The company is mainly focused on real estate projects that have positive impacts on society and environment. The minimum amount to invest into Anaxago’s project for for a retail investor is 1000 €.

| Saint-Martin 3rd | Bridge-Triplets d’Opérations | Rue Laroche-Bordeaux | |

| Loan description | Acquisition of a Haussmannian freestone building of 1,139m2 in the heart of the 3rd arrondissement of Paris. | Bridge financing aimed at the acquisition of office spaces in the Tour de la Villette and two hotel assets located in Haute-Savoie. | Acquisition of a hotel on rue laroche-Bordeaux |

| Country | France | France | France |

| Maturity (months) | 36 months | 24 months | 6-18 months |

| Amount collected | 4 150 000 € | 10 000 000 € | 4 100 100 € |

| Rate | 10,5 % | 9 % | 9,5 % |

| Closing date | 21-06-2023 | 17-03-2023 | 31-03-2022 |

| Instrument issued | Bonds convertible into shares | Bonds | NA |

| Distribution | In-fine | Quarter | In fine |

Most loans are secured on the Anaxago platform, it means that the loans are guaranteed and protect investors from repayment defaults.

The types of guatanteed available on Anaxago are: mortgage, trust, double signature on the centralizing account, guarentee, mortgage promise, unregistered mortgage.

Investing process as a retail investors

- To begin investing with Anaxago, prospective investors must first create an account on the platform. This step requires the submission of personal and financial information, including name, surname, email, phone number, ID card, and completion of the Know Your Customer (KYC) verification process.

- Investors then fund their account either through a credit card transaction or a bank transfer. These funds are managed securely by MangoPay, Anaxago’s chosen payment service provider. Importantly, the platform does not hold client funds directly, which significantly reduces potential financial risks in the unlikely event of a platform failure.

- Investors are then able to explore a variety of investment opportunities presented on Anaxago. The platform provides detailed information on each project to facilitate thorough due diligence. Investors also have the option to reach out directly to Anaxago for additional details about specific projects.

- Anaxago employs a unique approach by establishing a holding company for each investment. This holding company enters into an agreement with investors, effectively managing loan operations and consolidating investor interests for collective support.

- After making an investment, investors can monitor the progress of their investments through their Anaxago accounts. The platform keeps investors regularly updated on the status of projects they have invested in. Depending on the specific structure of the loan, investors will receive periodic payments or interest according to the agreed-upon schedule.

- In the event of any delays or defaults, Anaxago handles the entire recovery process efficiently and does not charge investors any additional fees for this service.

Team and management

The management team at Anaxago demonstrates a robust comprehension of financial services.

Joachim Dupont, President & Codounder of Anaxago

Joachim Dupont, President and Co-founder of Anaxago, has a finance-focused background. He served as a Financial Controller at AXA Corporate Solutions and worked in marketing and communication at Lazard Freres & Co. He holds multiple degrees from Université Paris Dauphine, including a Master’s in Corporate Financial Management and a Bachelor’s in Management, emphasizing his expertise in finance and business management. Dupont’s experience and education have been instrumental in shaping Anaxago’s financial strategies.

Caroline Dupont, Cofounder of Anaxago

Caroline Dupont, co-founder of Anaxago, brings a diverse educational background and experience in brand marketing to her role. She holds a Master’s degree in Management from ESCP Europe and University of the Arts London, complemented by a Master’s in Finance from Université Paris Dauphine-PSL. Her career includes experience at Christian Dior in luxury trade marketing. Caroline’s expertise in marketing and finance has been crucial in shaping Anaxago’s brand and operations.

Francois Carbone, Cofounder of Anaxago

Francois Carbone, a co-founder of Anaxago, the leading equity crowdfunding platform in France, has significantly contributed to its growth. Under his leadership, Anaxago has financed over 150 companies, invested more than 85 million euros, supported over 3000 housing projects, and grown to over 85,000 members. Additionally, Francois was an investor and board member at nextProtein from December 2016 to June 2022. Academically, he holds a Master’s degree in Financial Management from Université Paris Dauphine and a Bachelor’s degree in Economics and Management from the same university.

Mission and Values

Anaxago, with its mission centered on providing distinctive investment opportunities through its crowdfunding platform, places a significant emphasis on sustainability. At the heart of Anaxago’s philosophy are values such as innovation, prioritizing client needs, and dedication to responsible investments. The platform upholds a steadfast commitment to integrating environmental and social practices into its business model, ensuring that its investment opportunities not only yield financial returns but also contribute positively to societal and environmental objectives. Anaxago’s approach reflects a modern, conscientious investment ethos, resonating with both current and prospective investors who value ethical and sustainable business practices.

Trustfulness of the platform

Key investors of the company

Data is not available

Institutional lenders

Licenses

Registered as intermediary in participatory financing (IFP) under number 19001970 on the registry of ORIAS.

MangoPay SA limited company, registered under number B173459

Fees and charges

Entrance fees

Anaxago charges entry fees: between 0.5% and 2%

Management fees

Management fees : maximum 1%.

Liquidity and exit options

Investors must retain their loans until they reach maturity and are unable to sell their investments through the platform.

Users feedback

| Trustpilot | |

| Average rate | 4,5/5 |

| Good reviews | People appreciate the platform’s outstanding project selection, excellent communication with always available relationship managers. |

| Bad reviews | Anaxago offers a limited number of real estate crowdfunding options with very low terms and rates. Customer services are disappointing, late payment on projects. |

Risk Analysis

As an investment platform, investors need to be aware of certain key risks and understand how the platform manages them to ensure the safety of their funds.

Credit risk

Borrower default risk

Anaxago’s strategy in managing borrower default risk hinges on a stringent project selection and evaluation process. At the outset, the platform meticulously assesses the borrower’s profile, scrutinizing their financial stability, operational track record, and history of successfully completed projects, along with other vital metrics. This initial assessment is followed by a detailed review of the specific funded project, examining factors like land acquisition, regulatory approvals, sales pricing, construction costs, and project timelines. This thorough approach aids in identifying and mitigating potential risks, such as project non-fulfillment, delays, or reduced profitability.

An interesting aspect of Anaxago’s risk management is its credit scoring system, which grades projects from A (most favorable) to D (least favorable), providing a clear risk assessment for each operator’s project. Furthermore, Anaxago’s team of experienced analysts plays a pivotal role in the due diligence of projects. This rigorous selection process results in only about 1 to 3% of submitted projects being deemed eligible for funding on the platform.

Notably, Anaxago has generally observed a year-over-year decrease in default rates, although 2019 marked an exception with a peak rate of 10.4%. Since its establishment, only two projects have defaulted, highlighting the platform’s effective risk control measures. Anaxago’s emphasis on comprehensive risk assessment and selective project approval underlines its commitment to safeguarding investor interests and maintaining high standards of financial diligence.

Platform risk

Operational risk

Anaxago diligently addresses operational risks, particularly cyber risks, by implementing robust physical and logical security measures. To ensure the safeguarding of data stored on its platform, Anaxago employs advanced encryption for communication, facilitated through an AWS certificate. This measure is complemented by the deployment of firewalls and the encryption of storage spaces, which are crucial in maintaining the confidentiality and integrity of personal data, effectively preventing unauthorized access or use.

In line with its commitment to data security, Anaxago has established a comprehensive protection system that aligns with the stringent directives of the General Data Protection Regulation (GDPR) in Europe. This approach underlines Anaxago’s proactive stance in mitigating cyber threats and demonstrates its adherence to high standards of data protection, reinforcing the platform’s reliability and trustworthiness in managing operational risks.

Regulatory risk

Anaxago is a crowdfunding platform established in France. It holds approvals issued by local regulatory authorities, in particular the Financial Markets Authority (AMF) and the Registry of Insurance Intermediaries (ORIAS). These licenses ensure that the platform operates legally and in compliance with current regulatory standards, ensuring investment security for users. Therefore, no information has been given regarding implementation of ECSP (mandatory in European crowdfunding company in November 2023).

Platform failure

Anaxago employs a structured approach to mitigate the impacts of potential platform failure, primarily through its holding company. This entity plays a crucial role in safeguarding investors’ interests, especially in scenarios where project defaults occur. The holding company is tasked with managing and executing measures to prevent financial losses for investors, a critical function that demonstrates Anaxago’s commitment to investor protection.

In the event of a platform failure, the holding company is also responsible for initiating the transition process, which includes appointing a new manager to handle ongoing investments and operations. This mechanism ensures continuity and stability for investors, albeit the process may be intricate and time-intensive. This aspect of Anaxago’s operational framework underscores its strategic foresight in managing potential risks, although it also highlights the complexity involved in navigating such challenging situations. Investors are thus assured of a structured, albeit potentially protracted, resolution process in the unlikely event of platform insolvency.

Liquidity risk

Anaxago’s platform operates without a secondary market, meaning investors are expected to hold their loans until maturity. This absence of a secondary market is a key consideration for investors, as it directly impacts the liquidity of their investments. Consequently, it is essential for investors to be acutely aware of this limitation prior to committing their funds.

The lack of an immediate exit option underscores the importance of careful investment planning and risk assessment. Prospective investors should align their investment horizons with the maturity terms of the loans they select, considering the absence of a quick liquidation avenue. This arrangement is a fundamental aspect of Anaxago’s investment framework, emphasizing the need for strategic and long-term investment decisions. Investors are thus advised to consider the long-term nature of their investments and prepare accordingly for the duration of the loan period, keeping in mind the limited liquidity options available on the platform.

Fraud risk

Borrower fraud

Anaxago adopts a manual analysis approach for evaluating loan applications, ensuring a thorough assessment of each borrower. The process necessitates the submission of a comprehensive suite of documents by the borrowers, encompassing detailed financial records and extensive business project plans. This meticulous approach enables Anaxago to gain a deeper understanding of the borrower’s financial standing and the viability of their proposed projects.

Despite this rigorous evaluation process, Anaxago maintains a policy of non-disclosure regarding specific instances of fraud and their respective management strategies. This lack of transparency in reporting fraud occurrences and mitigation measures may lead to a sense of uncertainty among investors. While the platform’s detailed scrutiny of loan applications underscores its commitment to due diligence, the absence of openly shared information on fraud management may leave investors seeking more assurance about the platform’s capacity to identify and address fraudulent activities effectively.

Anaxago’s careful selection and vetting of borrowers demonstrate its dedication to protecting investor interests. However, the platform’s discretion in disclosing fraud-related incidents and resolutions highlights a potential area for greater transparency to bolster investor confidence.

Platform fraud

Anaxago ensures the security of investors’ funds through a robust structure where the management of client money is externalized. The funds are securely held by MangoPay, a reputable payment service provider, which adds a layer of protection against mismanagement. This arrangement significantly reduces the risk of unauthorized access to funds by Anaxago’s managers.

Furthermore, the investment process on Anaxago is structured through a holding company mechanism. Investors become shareholders in this holding company when they make investments on the platform. This setup not only reinforces the security of the funds but also introduces a level of corporate governance. It creates a barrier against potential misappropriation of funds, as any significant financial movement would require shareholder authorization.

This dual-layered approach, combining the use of an external payment service provider and a holding company structure, ensures a higher degree of safety for investor funds. It instills confidence in the platform’s commitment to ethical financial management and adherence to best practices in safeguarding investor interests. Anaxago’s model demonstrates its dedication to maintaining trust and integrity in its operations, providing reassurance to its investor community.

ESG risk

Anaxago’s dedication to environmental and societal responsibilities is evident in its recent amendment of by-laws, positioning it as a trailblazer in the financial sector recognized as a mission-driven company. From 2023, the platform has integrated a comprehensive methodology to assess the ESG impact of its operations and funded projects. This methodology encompasses a multi-faceted approach:

- Qualitative and Quantitative Analysis: Conducted by the financing committee, this analysis delves into the intricate details of each project, considering both qualitative aspects and quantifiable metrics.

- Custom Scoring System: Anaxago has developed its own scoring criteria, tailored to evaluate projects based on their alignment with ESG principles. This scoring system aids in the objective assessment of potential investments.

- Historical Evaluation: An added layer of scrutiny involves examining a company’s track record. Anaxago evaluates the historical performance of companies with respect to their ESG commitments and practices, ensuring a thorough understanding of their long-term commitment to sustainable and ethical operations.

While Anaxago’s commitment to ESG considerations is commendable, it’s notable that the specific details of the ESG scoring are not publicly displayed. This lack of transparency could be an area for further development, enabling investors to gain deeper insights into how ESG factors are weighted and applied in investment decisions. Nonetheless, Anaxago’s integration of ESG considerations into its core operations reflects its proactive stance in promoting sustainable and responsible investment practices.